Forex Deep Learning validation.

CHAPTER 2

problems from chapter 1:

-the model is learning only to predict bearish positions somehow, regardless diversified dataset.

-the model is overfitted, it is making predictions only in 10 months out of 40

Goals for this chapter:

-create one function to calculate the mdoel performance on many fields

-Apply Conv1D layers

1.1 Import libriaries and the model

Libriaries

import matplotlib

import numpy as np

import pandas as pd

import itertools

import sklearn

import keras

import time

import shap

import datetime

from keras.models import Sequential

from keras.layers import Dense, Dropout, CuDNNLSTM, Conv1D

from matplotlib import pyplot as plt

from sklearn import preprocessing

from sklearn.model_selection import train_test_split

import matplotlib.pyplot as plt

import matplotlib.ticker as mticker

from mpl_finance import candlestick_ohlc

import seaborn as sns

print('Numpy version: ' + np.__version__)

print('Pandas version: ' + pd.__version__)

print('Matplotlib version: ' + matplotlib.__version__)

print('Sklearn version: ' + sklearn.__version__)

print('Keras version: ' + keras.__version__)

Numpy version: 1.16.4

Pandas version: 0.24.2

Matplotlib version: 3.1.0

Sklearn version: 0.21.2

Keras version: 2.2.4

model

# model name: predict_candlestick_1.8.h5

from keras.models import load_model

model = load_model('predict_candlestick_1.8.h5')

model.summary()

1.2 import feature engineering functions and dataset

Function to plot candlestick charts

def graph_data_ohlc(dataset):

fig = plt.figure()

ax1 = plt.subplot2grid((1,1), (0,0))

closep=dataset[:,[3]]

highp=dataset[:,[1]]

lowp=dataset[:,[2]]

openp=dataset[:,[0]]

date=range(len(closep))

x = 0

y = len(date)

ohlc = []

while x < y:

append_me = date[x], openp[x], highp[x], lowp[x], closep[x]

ohlc.append(append_me)

x+=1

candlestick_ohlc(ax1, ohlc, width=0.4, colorup='#77d879', colordown='#db3f3f')

for label in ax1.xaxis.get_ticklabels():

label.set_rotation(45)

ax1.xaxis.set_major_locator(mticker.MaxNLocator(10))

ax1.grid(True)

plt.xlabel('Candle')

plt.ylabel('Price')

plt.title('Candlestick sample representation')

plt.subplots_adjust(left=0.09, bottom=0.20, right=0.94, top=0.90, wspace=0.2, hspace=0)

plt.show()

Function to convert OHLC data to candlestick data in form of pip values

def ohlc_to_candlestick(conversion_array):

candlestick_data = [0,0,0,0]

if conversion_array[4]>conversion_array[1]:

candle_type=1

wicks_up=conversion_array[2]-conversion_array[4]

wicks_down=conversion_array[3]-conversion_array[1]

body_size=conversion_array[4]-conversion_array[1]

else:

candle_type=0

wicks_up=conversion_array[2]-conversion_array[1]

wicks_down=conversion_array[3]-conversion_array[4]

body_size=conversion_array[2]-conversion_array[4]

if wicks_up < 0:wicks_up=wicks_up*(-1)

if wicks_down < 0:wicks_down=wicks_down*(-1)

if body_size < 0:body_size=body_size*(-1)

candlestick_data[0]=candle_type

candlestick_data[1]=round(round(wicks_up,5)*10000,2)

candlestick_data[2]=round(round(wicks_down,5)*10000,2)

candlestick_data[3]=round(round(body_size,5)*10000,2)

return candlestick_data

Function to generate time series sequence

def my_generator_candle_X_Y(data,lookback,MinMax = False,Multi=False):

if MinMax==True:scaler = preprocessing.MinMaxScaler()

first_row = 0

arr = np.empty((0,lookback,4))

arr3 = np.empty((0,lookback,5))

Y_list = []

Y_dates_list = []

for a in range(len(data)-lookback):

temp_list = []

temp_list_raw = []

for candle in data[first_row:first_row+lookback]:

converted_data = ohlc_to_candlestick(candle)

temp_list.append(converted_data)

temp_list_raw.append(candle)

temp_list3 = [np.asarray(temp_list)]

templist4 = np.asarray(temp_list3)

if MinMax==True:

templist99 = scaler.fit_transform(templist4[0])

arr = np.append(arr, [templist99], axis=0)

else:

arr = np.append(arr, templist4, axis=0)

temp_list7 = [np.asarray(temp_list_raw)]

templist8 = np.asarray(temp_list7)

arr3 = np.append(arr3, templist8, axis=0)

converted_data_prediction = ohlc_to_candlestick(data[first_row+lookback])

Prediction = converted_data_prediction[0]

if Multi==True:

if Prediction== 1: Prediction=[1,0]

if Prediction== 0: Prediction=[0,1]

Y_list.append(np.asarray(Prediction))

if Multi==False:

Y_list.append(Prediction)

Y_dates_list.append(data[first_row+lookback][0])

first_row=first_row+1

arr2 = np.asarray(Y_list)

arr4 = np.asarray(Y_dates_list)

return arr,arr2,arr3,arr4

Load the EURUSD 2003 - 2019 , 1h candle sticks dataset from ducascopy.com

EURUSD_dataset = pd.read_csv('Hour/EURUSD.csv')

del EURUSD_dataset['Volume']

X,Y, X_raw, Y_dates = my_generator_candle_X_Y(EURUSD_dataset.values,3,MinMax=False)

Make the model predictions

raw_predictions = model.predict(X)

1.4 - Performance function

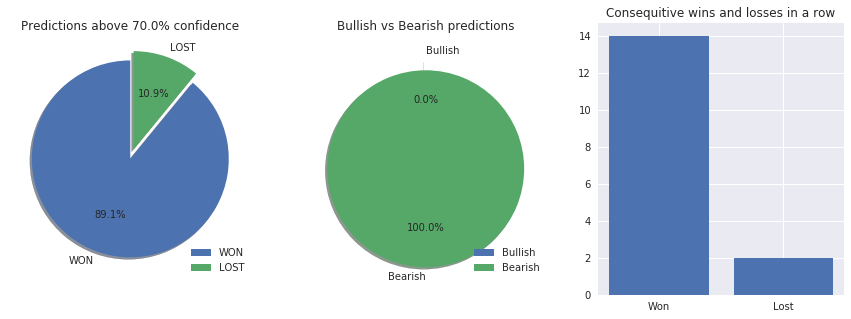

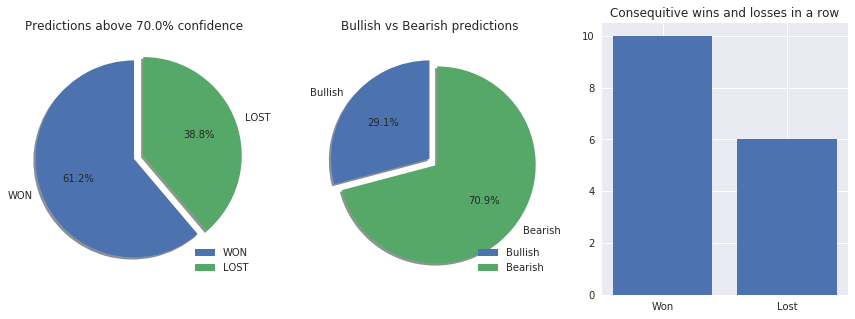

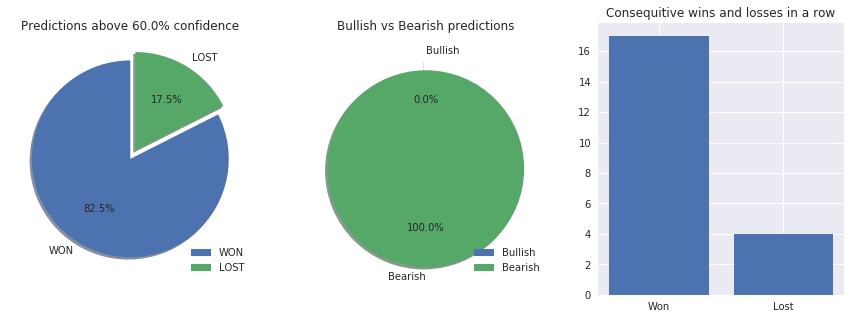

This function should contain:

- Profitability with % (WON% & LOSS %)

- Number of Bullish & Bearish predictions

- Consequative win and looses in a row

- Bar chart with total number of trades per each month

- Heatmap with weekday vs the hours (spot the high activity hours during the week)

Let’s divide it to small functions that will perform only one action and the we will create one function to merge them all.

1.4.1 - Profitability with % (WON% & LOSS %)

def get_win_loss_stat(alpha_distance,raw_predictions, target_predictions):

counter = 0

won = 0

lost = 0

for a in raw_predictions:

if a > (1-alpha_distance) or a < alpha_distance :

if (a > (1-alpha_distance) and target_predictions[counter] == 1) or (a < alpha_distance and target_predictions[counter] == 0):

won=won+1

else:

lost=lost+1

counter=counter+1

return [won,lost]

won,lost = get_win_loss_stat(0.4,raw_predictions, Y)

print('Won: ' + str(won) + ' Lost: ' + str(lost) + ' Total:' + str(won+lost))

Won: 673 Lost: 345 Total:1018

1.4.2 - Number of Bullish & Bearish predictions

def get_bullish_bearish_stat(alpha_distance,raw_predictions):

bullish_count=0

bearish_count=0

for pred in raw_predictions:

if pred < alpha_distance: bearish_count=bearish_count+1

if pred > (1-alpha_distance): bullish_count=bullish_count+1

return [bullish_count,bearish_count]

bullish,bearish = get_bullish_bearish_stat(0.4,raw_predictions)

print('Bullish: ' + str(bullish) + ' Bearish: ' + str(bearish) + ' Total:' + str(bullish+bearish))

Bullish: 0 Bearish: 1018 Total:1018

1.4.3 - Consequative win and looses in a row

def get_consequitive_trades_stat(alpha_distance,raw_predictions,target_predictions):

counter = 0

ConsequtiveStats = []

for a in raw_predictions:

if a > (1-alpha_distance) or a < alpha_distance :

if (a > (1-alpha_distance) and target_predictions[counter] == 1) or (a < alpha_distance and target_predictions[counter] == 0):

ConsequtiveStats.append(1)

else:

ConsequtiveStats.append(0)

counter=counter+1

z = [(x[0], len(list(x[1]))) for x in itertools.groupby(ConsequtiveStats)]

MaxLost = 0

MaxWon = 0

for a in z:

if a[0]==0:

if a[1] > MaxLost: MaxLost = a[1]

else:

if a[1] > MaxWon: MaxWon = a[1]

return [MaxWon,MaxLost]

max_con_wins,max_con_lost = get_consequitive_trades_stat(0.4,raw_predictions,Y)

print('Max consequitive wins: ' + str(max_con_wins) + ' Max consequitive looses: ' + str(max_con_lost))

Max consequitive wins: 28 Max consequitive looses: 6

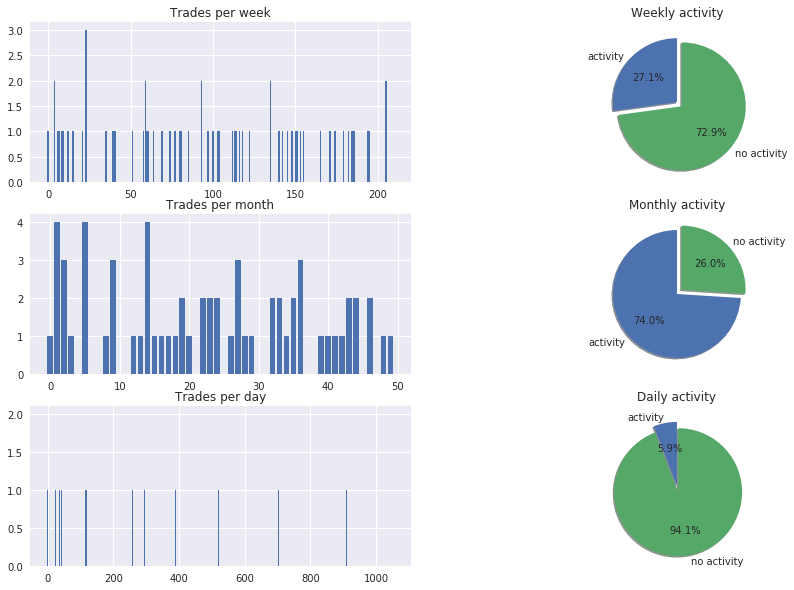

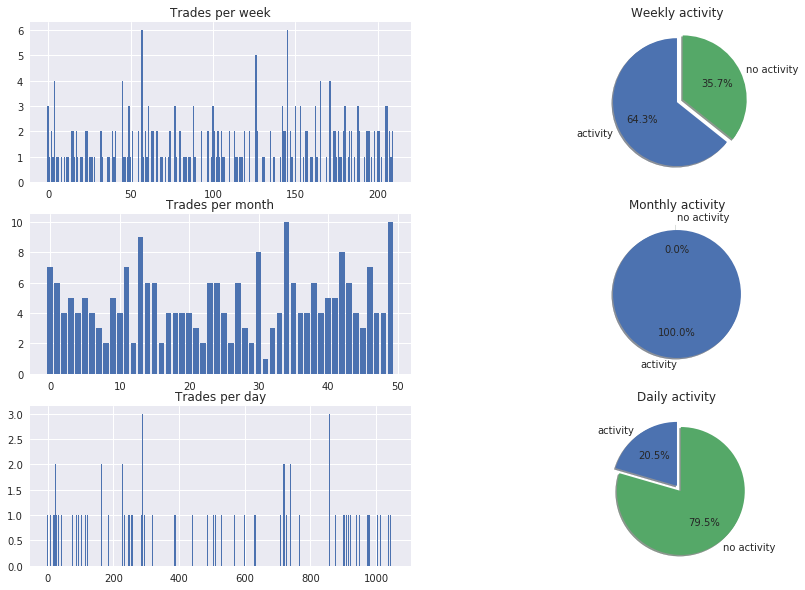

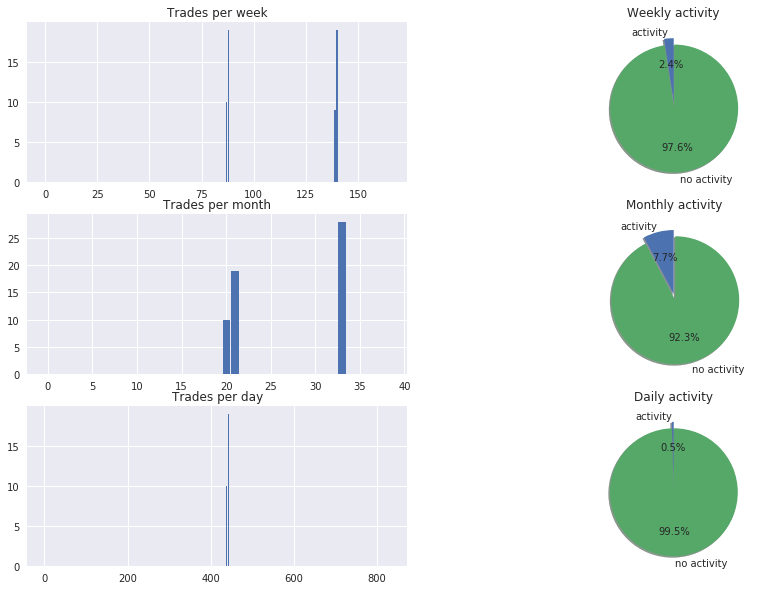

1.4.4 - Bar chart with total number of trades per each month

def get_trades_per_period_stat(alpha_distance,raw_predictions,timeperiod):

output = []

templist=[]

addval=0

counter=0

for pre in raw_predictions:

if counter % timeperiod == 0 and counter != 0 :

output.append(sum(templist.copy()))

templist=[]

if pre < alpha_distance: addval = 1

elif pre > (1-alpha_distance): addval = 1

else:

addval = 0

templist.append(addval)

counter=counter+1

return output

# Hours in: [Day:24], [Week:120], [Month:504]

trades_per_month = get_trades_per_period_stat(0.4,raw_predictions,504)

months_with_trades = len(list(filter(lambda trades_per_month: trades_per_month > 0, trades_per_month)))

months_with_zero_trades = len(list(filter(lambda trades_per_month: trades_per_month == 0, trades_per_month)))

print('Months with trades: ' + str(months_with_trades) + ' ,Months with no trades: ' + str(months_with_zero_trades))

print('Test period in months: ' + str(months_with_trades+months_with_zero_trades))

print('Test period in years: ' + str(round((months_with_trades+months_with_zero_trades)/12,1)))

Months with trades: 172 ,Months with no trades: 28

Test period in months: 200

Test period in years: 16.7

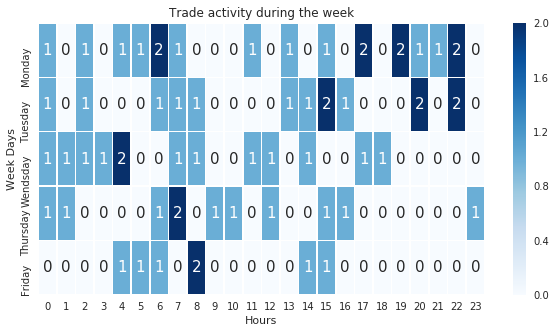

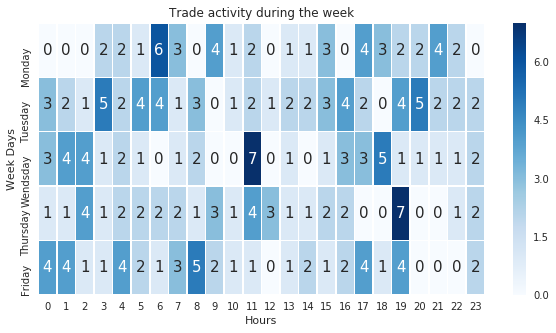

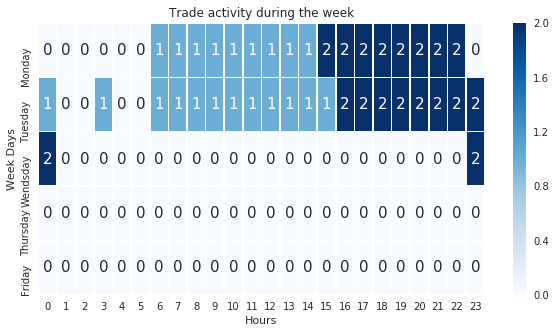

1.4.5 - Heatmap with weekday vs the hours (spot the high activity hours during the week)

def get_week_activity(alpha_distance,raw_predictions,date_values):

Monday_ls = [0] * 24

Tuesday_ls = [0] * 24

Wendsday_ls = [0] * 24

Thursday_ls = [0] * 24

Friday_ls = [0] * 24

counter = 0

for a in raw_predictions:

if a > (1-alpha_distance) or a < alpha_distance :

raw_date_converted = datetime.datetime.strptime(date_values[counter], '%d.%m.%Y %H:%M:%S.000')

week_day = raw_date_converted.weekday()

hour = raw_date_converted.hour

if week_day==0: Monday_ls[hour-1]=Monday_ls[hour-1]+1

if week_day==1: Tuesday_ls[hour-1]=Tuesday_ls[hour-1]+1

if week_day==2: Wendsday_ls[hour-1]=Wendsday_ls[hour-1]+1

if week_day==3: Thursday_ls[hour-1]=Thursday_ls[hour-1]+1

if week_day==4: Friday_ls[hour-1]=Friday_ls[hour-1]+1

counter=counter+1

return [Monday_ls,Tuesday_ls,Wendsday_ls,Thursday_ls,Friday_ls]

week_activity=get_week_activity(0.4,raw_predictions,Y_dates)

print('Trades on Monday: ' + str(sum(week_activity[0])))

print('Trades on Tuesday: ' + str(sum(week_activity[1])))

print('Trades on Wendsday: ' + str(sum(week_activity[2])))

print('Trades on Thursday: ' + str(sum(week_activity[3])))

print('Trades on Friday: ' + str(sum(week_activity[4])))

print('Total Trades: ' + str(sum(week_activity[0])+sum(week_activity[1])+sum(week_activity[2])+sum(week_activity[3])+sum(week_activity[4])))

Trades on Monday: 249

Trades on Tuesday: 238

Trades on Wendsday: 171

Trades on Thursday: 180

Trades on Friday: 157

Total Trades: 995

1.5 - Mergin stats functions in to on big function.

To fully test the function, we need the training history data, so to get this, we will create our model from scratch and train it

Load the dataset

EURUSD_dataset = pd.read_csv('Hour/EURUSD.csv')

del EURUSD_dataset['Volume']

X,Y, X_raw, Y_dates = my_generator_candle_X_Y(EURUSD_dataset.values,3,MinMax=False)

X_train, X_val_and_test, Y_train, Y_val_and_test = train_test_split(X, Y, test_size=0.5)

X_val, X_test, Y_val, Y_test = train_test_split(X_val_and_test, Y_val_and_test, test_size=0.5)

X_train_raw, X_val_and_test_raw,Y_dates_train,Y_dates_val_and_test= train_test_split(X_raw,Y_dates ,test_size=0.5)

X_val_raw, X_test_raw,Y_dates_val,Y_dates_test = train_test_split(X_val_and_test_raw,Y_dates_val_and_test, test_size=0.5)

Create model

from keras import layers

from keras.optimizers import RMSprop

model = Sequential()

model.add(layers.CuDNNLSTM(units = 12,return_sequences=True, input_shape = (None, X.shape[-1])))

model.add(Dropout(0.3))

model.add(layers.CuDNNLSTM(units = 24,return_sequences=True,))

model.add(Dropout(0.3))

model.add(layers.CuDNNLSTM(units = 24,return_sequences=True))

model.add(Dropout(0.3))

model.add(layers.CuDNNLSTM(units = 24,return_sequences=True))

model.add(Dropout(0.2))

model.add(layers.CuDNNLSTM(units = 12,return_sequences=True))

model.add(Dropout(0.2))

model.add(layers.CuDNNLSTM(units = 6))

model.add(layers.Dense(units = 1,activation='sigmoid'))

model.compile(optimizer='rmsprop', loss='binary_crossentropy', metrics=['acc'])

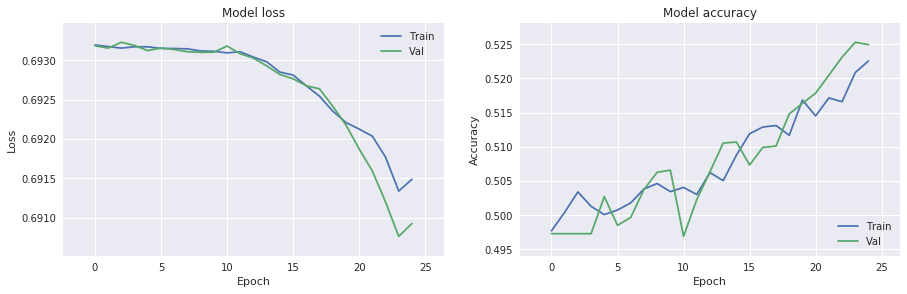

Train the model and pass all the training data in to the ‘history’ variable

history = model.fit(X_train, Y_train,batch_size=500, epochs=25,validation_data=(X_val, Y_val))

Train on 50578 samples, validate on 25289 samples

Epoch 1/25

50578/50578 [==============================] - 5s 105us/step - loss: 0.6932 - acc: 0.4977 - val_loss: 0.6932 - val_acc: 0.4973

Epoch 2/25

50578/50578 [==============================] - 3s 54us/step - loss: 0.6932 - acc: 0.5004 - val_loss: 0.6932 - val_acc: 0.4973

Epoch 3/25

50578/50578 [==============================] - 3s 56us/step - loss: 0.6932 - acc: 0.5034 - val_loss: 0.6932 - val_acc: 0.4973

Epoch 4/25

50578/50578 [==============================] - 3s 51us/step - loss: 0.6932 - acc: 0.5013 - val_loss: 0.6932 - val_acc: 0.4973

Epoch 5/25

50578/50578 [==============================] - 2s 48us/step - loss: 0.6932 - acc: 0.5001 - val_loss: 0.6931 - val_acc: 0.5027

Epoch 6/25

50578/50578 [==============================] - 2s 46us/step - loss: 0.6931 - acc: 0.5008 - val_loss: 0.6932 - val_acc: 0.4985

Epoch 7/25

50578/50578 [==============================] - 2s 49us/step - loss: 0.6931 - acc: 0.5018 - val_loss: 0.6931 - val_acc: 0.4997

Epoch 8/25

50578/50578 [==============================] - 2s 46us/step - loss: 0.6931 - acc: 0.5038 - val_loss: 0.6931 - val_acc: 0.5037

Epoch 9/25

50578/50578 [==============================] - 2s 46us/step - loss: 0.6931 - acc: 0.5046 - val_loss: 0.6931 - val_acc: 0.5063

Epoch 10/25

50578/50578 [==============================] - 3s 52us/step - loss: 0.6931 - acc: 0.5034 - val_loss: 0.6931 - val_acc: 0.5066

Epoch 11/25

50578/50578 [==============================] - 2s 49us/step - loss: 0.6931 - acc: 0.5041 - val_loss: 0.6932 - val_acc: 0.4969

Epoch 12/25

50578/50578 [==============================] - 2s 48us/step - loss: 0.6931 - acc: 0.5030 - val_loss: 0.6931 - val_acc: 0.5023

Epoch 13/25

50578/50578 [==============================] - 2s 48us/step - loss: 0.6930 - acc: 0.5062 - val_loss: 0.6930 - val_acc: 0.5063

Epoch 14/25

50578/50578 [==============================] - 2s 47us/step - loss: 0.6930 - acc: 0.5050 - val_loss: 0.6929 - val_acc: 0.5105

Epoch 15/25

50578/50578 [==============================] - 2s 46us/step - loss: 0.6928 - acc: 0.5088 - val_loss: 0.6928 - val_acc: 0.5107

Epoch 16/25

50578/50578 [==============================] - 2s 46us/step - loss: 0.6928 - acc: 0.5119 - val_loss: 0.6928 - val_acc: 0.5073

Epoch 17/25

50578/50578 [==============================] - 3s 56us/step - loss: 0.6927 - acc: 0.5129 - val_loss: 0.6927 - val_acc: 0.5099

Epoch 18/25

50578/50578 [==============================] - 2s 47us/step - loss: 0.6925 - acc: 0.5131 - val_loss: 0.6926 - val_acc: 0.5101

Epoch 19/25

50578/50578 [==============================] - 2s 46us/step - loss: 0.6924 - acc: 0.5117 - val_loss: 0.6924 - val_acc: 0.5148

Epoch 20/25

50578/50578 [==============================] - 2s 47us/step - loss: 0.6922 - acc: 0.5168 - val_loss: 0.6922 - val_acc: 0.5164

Epoch 21/25

50578/50578 [==============================] - 2s 46us/step - loss: 0.6921 - acc: 0.5145 - val_loss: 0.6919 - val_acc: 0.5179

Epoch 22/25

50578/50578 [==============================] - 2s 46us/step - loss: 0.6920 - acc: 0.5171 - val_loss: 0.6916 - val_acc: 0.5205

Epoch 23/25

50578/50578 [==============================] - 2s 46us/step - loss: 0.6918 - acc: 0.5166 - val_loss: 0.6912 - val_acc: 0.5231

Epoch 24/25

50578/50578 [==============================] - 2s 48us/step - loss: 0.6913 - acc: 0.5209 - val_loss: 0.6908 - val_acc: 0.5253

Epoch 25/25

50578/50578 [==============================] - 2s 49us/step - loss: 0.6915 - acc: 0.5226 - val_loss: 0.6909 - val_acc: 0.5249

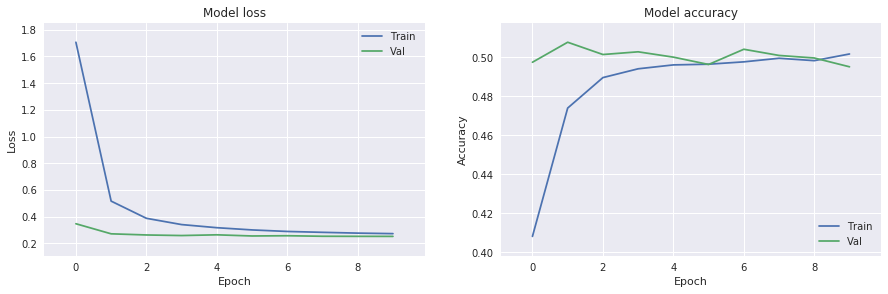

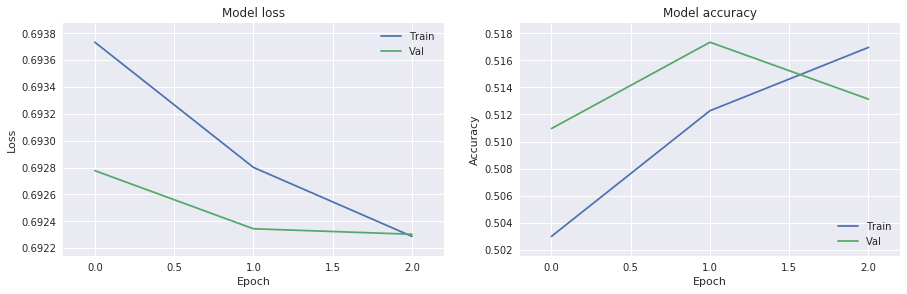

1.5.2 - Create final function for model evaluation

def get_model_insights(my_model,training_history,alpha_distance,X_input,Y_output,Y_datetimes):

#Y_output

raw_predictions=my_model.predict(X_input)

if len(raw_predictions[0]) >1:

new_predictions_raw = []

new_Y_output = []

for a in raw_predictions:

new_predictions_raw.append(a[0])

for b in Y_output:

new_Y_output.append(b[0])

raw_predictions=np.asarray(new_predictions_raw)

Y_output=np.asarray(new_Y_output)

split_time_period_month = 504

split_time_period_week = 120

split_time_period_day = 24

won,lost = get_win_loss_stat(alpha_distance,raw_predictions, Y_output)

bullish,bearish = get_bullish_bearish_stat(alpha_distance,raw_predictions)

max_con_wins,max_con_lost = get_consequitive_trades_stat(alpha_distance,raw_predictions,Y_output)

trades_per_month = get_trades_per_period_stat(alpha_distance,raw_predictions,split_time_period_month)

trades_per_week = get_trades_per_period_stat(alpha_distance,raw_predictions,split_time_period_week)

trades_per_day = get_trades_per_period_stat(alpha_distance,raw_predictions,split_time_period_day)

week_activity=get_week_activity(alpha_distance,raw_predictions,Y_datetimes)

# plot the charts

plt.style.use('seaborn')

f = plt.figure(figsize=(15,30))

# model training loss function

ax = f.add_subplot(621)

ax.margins(0.1)

ax.plot(training_history.history['loss'])

ax.plot(training_history.history['val_loss'])

ax.set_title('Model loss')

ax.set_ylabel('Loss')

ax.set_xlabel('Epoch')

ax.legend(['Train', 'Val'], loc='upper right')

# model training accuracy

ax2 = f.add_subplot(622)

ax2.margins(0.1)

ax2.plot(training_history.history['acc'])

ax2.plot(training_history.history['val_acc'])

ax2.set_title('Model accuracy')

ax2.set_ylabel('Accuracy')

ax2.set_xlabel('Epoch')

ax2.legend(['Train', 'Val'], loc='lower right')

plt.show

f = plt.figure(figsize=(15,5))

ax3 = f.add_subplot(131)

labels = 'WON', 'LOST'

sizes = [won, lost]

explode = (0, 0.1)

ax3.pie(sizes, explode=explode, labels=labels, autopct='%1.1f%%',shadow=True, startangle=90)

ax3.set_title('Predictions above ' + str((round(1-alpha_distance,2)*100)) + '% confidence')

ax3.legend(['WON', 'LOST'], loc='lower right')

ax4 = f.add_subplot(132)

labels = 'Bullish', 'Bearish'

sizes = [bullish,bearish]

explode = (0, 0.1)

ax4.pie(sizes, explode=explode, labels=labels, autopct='%1.1f%%',shadow=True, startangle=90)

ax4.set_title('Bullish vs Bearish predictions')

ax4.legend(['Bullish', 'Bearish'], loc='lower right')

ax8 = f.add_subplot(133)

ax8.set_title('Consequitive wins and losses in a row')

x = ['Won','Lost']

ax8.bar(x, [max_con_wins,max_con_lost])

ax8.set_xticks(x, ('Won','Lost'))

plt.show

f = plt.figure(figsize=(15,10))

ax5 = f.add_subplot(321)

ax5.set_title('Trades per week')

x = range(len(trades_per_week))

ax5.bar(x, trades_per_week)

weeks_with_trades = len(list(filter(lambda trades_per_week: trades_per_week > 0, trades_per_week)))

weeks_with_zero_trades = len(list(filter(lambda trades_per_week: trades_per_week == 0, trades_per_week)))

ax3 = f.add_subplot(322)

labels = 'activity', 'no activity'

sizes = [weeks_with_trades, weeks_with_zero_trades]

explode = (0, 0.1)

ax3.pie(sizes, explode=explode, labels=labels, autopct='%1.1f%%',shadow=True, startangle=90)

ax3.set_title('Weekly activity')

ax6 = f.add_subplot(323)

ax6.set_title('Trades per month')

x = range(len(trades_per_month))

ax6.bar(x, trades_per_month)

months_with_trades = len(list(filter(lambda trades_per_month: trades_per_month > 0, trades_per_month)))

months_with_zero_trades = len(list(filter(lambda trades_per_month: trades_per_month == 0, trades_per_month)))

ax34 = f.add_subplot(324)

labels = 'activity', 'no activity'

sizes = [months_with_trades, months_with_zero_trades]

explode = (0, 0.1)

ax34.pie(sizes, explode=explode, labels=labels, autopct='%1.1f%%',shadow=True, startangle=90)

ax34.set_title('Monthly activity')

ax7 = f.add_subplot(325)

ax7.set_title('Trades per day')

x = range(len(trades_per_day))

ax7.bar(x, trades_per_day)

days_with_trades = len(list(filter(lambda trades_per_day: trades_per_day > 0, trades_per_day)))

days_with_zero_trades = len(list(filter(lambda trades_per_day: trades_per_day == 0, trades_per_day)))

ax32 = f.add_subplot(326)

labels = 'activity', 'no activity'

sizes = [days_with_trades, days_with_zero_trades]

explode = (0, 0.1)

ax32.pie(sizes, explode=explode, labels=labels, autopct='%1.1f%%',shadow=True, startangle=90)

ax32.set_title('Daily activity')

plt.show

weekdays=['Monday','Tuesday','Wendsday','Thursday','Friday']

plt.figure(figsize=(10,5))

ax = sns.heatmap(week_activity,annot=True,annot_kws={"size": 15},

linewidth=0.5, yticklabels=weekdays,cmap="Blues")

plt.title('Trade activity during the week')

ax.set_ylabel('Week Days')

ax.set_xlabel('Hours')

plt.show

return(True)

test=get_model_insights(model,history,0.3,X_test,Y_test,Y_dates_test)

We can now have a tool to clearly see insights of our trained model.

Before finish of this chapter, Lets checck if we can get better results with Convolutional 1D netwok.

from keras.layers import Dense, Dropout, CuDNNLSTM, Conv1D,MaxPooling1D,Flatten

model = Sequential()

model.add(Conv1D(filters=32, kernel_size=2, activation='relu', input_shape=(3, 4)))

model.add(Dropout(0.5))

model.add(MaxPooling1D(pool_size=2))

model.add(Flatten())

model.add(Dense(100, activation='relu'))

model.add(Dense(1))

model.compile(optimizer='adam', loss='mse', metrics=['acc'])

history=model.fit(X_train, Y_train,batch_size=500, epochs=10,validation_data=(X_val, Y_val))

Train on 50578 samples, validate on 25289 samples

Epoch 1/10

50578/50578 [==============================] - 3s 59us/step - loss: 1.7065 - acc: 0.4082 - val_loss: 0.3468 - val_acc: 0.4974

Epoch 2/10

50578/50578 [==============================] - 1s 16us/step - loss: 0.5164 - acc: 0.4739 - val_loss: 0.2713 - val_acc: 0.5077

Epoch 3/10

50578/50578 [==============================] - 1s 16us/step - loss: 0.3876 - acc: 0.4895 - val_loss: 0.2627 - val_acc: 0.5014

Epoch 4/10

50578/50578 [==============================] - 1s 16us/step - loss: 0.3405 - acc: 0.4940 - val_loss: 0.2584 - val_acc: 0.5027

Epoch 5/10

50578/50578 [==============================] - 1s 16us/step - loss: 0.3172 - acc: 0.4960 - val_loss: 0.2638 - val_acc: 0.5000

Epoch 6/10

50578/50578 [==============================] - 1s 16us/step - loss: 0.3005 - acc: 0.4964 - val_loss: 0.2551 - val_acc: 0.4963

Epoch 7/10

50578/50578 [==============================] - 1s 16us/step - loss: 0.2890 - acc: 0.4976 - val_loss: 0.2570 - val_acc: 0.5041

Epoch 8/10

50578/50578 [==============================] - 1s 17us/step - loss: 0.2824 - acc: 0.4994 - val_loss: 0.2530 - val_acc: 0.5009

Epoch 9/10

50578/50578 [==============================] - 1s 17us/step - loss: 0.2765 - acc: 0.4982 - val_loss: 0.2524 - val_acc: 0.4996

Epoch 10/10

50578/50578 [==============================] - 1s 16us/step - loss: 0.2727 - acc: 0.5016 - val_loss: 0.2521 - val_acc: 0.4951

test=get_model_insights(model,history,0.3,X_test,Y_test,Y_dates_test)

The good news is that our model at least predict also the bullish candles.

EURUSD_dataset = pd.read_csv('Hour/EURUSD.csv')

del EURUSD_dataset['Volume']

X,Y, X_raw, Y_dates = my_generator_candle_X_Y(EURUSD_dataset.values,15,MinMax=True,Multi=True)

X_train, X_val_and_test, Y_train, Y_val_and_test = train_test_split(X, Y, test_size=0.5)

X_val, X_test, Y_val, Y_test = train_test_split(X_val_and_test, Y_val_and_test, test_size=0.5)

X_train_raw, X_val_and_test_raw,Y_dates_train,Y_dates_val_and_test= train_test_split(X_raw,Y_dates ,test_size=0.5)

X_val_raw, X_test_raw,Y_dates_val,Y_dates_test = train_test_split(X_val_and_test_raw,Y_dates_val_and_test, test_size=0.5)

from keras.layers import Dense, Dropout, CuDNNLSTM, Conv1D,MaxPooling1D,Flatten,Convolution1D,Activation

model = Sequential()

model.add(Convolution1D(input_shape = (15,4),

nb_filter=64,

filter_length=2,

border_mode='valid',

activation='relu',

subsample_length=1))

model.add(MaxPooling1D(pool_length=2))

model.add(Convolution1D(input_shape = (15,4),

nb_filter=64,

filter_length=2,

border_mode='valid',

activation='relu',

subsample_length=1))

model.add(MaxPooling1D(pool_length=2))

model.add(Dropout(0.25))

model.add(Flatten())

model.add(Dense(250))

model.add(Dropout(0.25))

model.add(Activation('relu'))

model.add(Dense(2))

model.add(Activation('softmax'))

#history = TrainingHistory()

model.compile(optimizer='adam',

loss='binary_crossentropy',

metrics=['accuracy'])

/opt/conda/lib/python3.6/site-packages/ipykernel_launcher.py:8: UserWarning: Update your `Conv1D` call to the Keras 2 API: `Conv1D(input_shape=(15, 4), activation="relu", filters=64, kernel_size=2, strides=1, padding="valid")`

/opt/conda/lib/python3.6/site-packages/ipykernel_launcher.py:9: UserWarning: Update your `MaxPooling1D` call to the Keras 2 API: `MaxPooling1D(pool_size=2)`

if __name__ == '__main__':

/opt/conda/lib/python3.6/site-packages/ipykernel_launcher.py:16: UserWarning: Update your `Conv1D` call to the Keras 2 API: `Conv1D(input_shape=(15, 4), activation="relu", filters=64, kernel_size=2, strides=1, padding="valid")`

app.launch_new_instance()

/opt/conda/lib/python3.6/site-packages/ipykernel_launcher.py:17: UserWarning: Update your `MaxPooling1D` call to the Keras 2 API: `MaxPooling1D(pool_size=2)`

history=model.fit(X_train, Y_train,batch_size=500, epochs=10,validation_data=(X_val, Y_val))

test=get_model_insights(model,history,0.3,X_test,Y_test,Y_dates_test)

EURUSD_dataset = pd.read_csv('Hour/EURUSD.csv')

del EURUSD_dataset['Volume']

GBPUSD_dataset = pd.read_csv('Hour/GBPUSD.csv')

del GBPUSD_dataset['Volume']

train_gen=my_generator_candle_X_Y_CPU(EURUSD_dataset.values,15,500,return_more=False,MinMax=True,Multi=True)

val_gen=my_generator_candle_X_Y_CPU(GBPUSD_dataset.values,15,500,return_more=False,MinMax=True,Multi=True)

history = model.fit_generator(train_gen,

steps_per_epoch=200,

epochs=3,

validation_data=val_gen,

validation_steps=200)

Epoch 1/3

200/200 [==============================] - 143s 715ms/step - loss: 0.6937 - acc: 0.5030 - val_loss: 0.6928 - val_acc: 0.5110

Epoch 2/3

200/200 [==============================] - 130s 648ms/step - loss: 0.6928 - acc: 0.5123 - val_loss: 0.6923 - val_acc: 0.5173

Epoch 3/3

200/200 [==============================] - 130s 652ms/step - loss: 0.6923 - acc: 0.5170 - val_loss: 0.6923 - val_acc: 0.5131

AUDUSD_dataset = pd.read_csv('Hour/AUDUSD.csv').tail(20000)

del AUDUSD_dataset['Volume']

X,Y, X_raw, Y_dates = my_generator_candle_X_Y(AUDUSD_dataset.values,15,MinMax=True,Multi=True)

test=get_model_insights(model,history,0.4,X,Y,Y_dates)

def my_generator_candle_X_Y_CPU(data,lookback,batch_size,return_more=True,MinMax=False,Multi=False):

if MinMax==True:scaler = preprocessing.MinMaxScaler()

batch_rows = round(len(data)/batch_size,0)

first_row = 0

while 1:

arr = np.empty((0,lookback,4))

arr3 = np.empty((0,lookback,5))

Y_list = []

Y_dates_list = []

for a in range(int(batch_size)-lookback):

temp_list = []

temp_list_raw = []

for candle in data[first_row:first_row+lookback]:

converted_data = ohlc_to_candlestick(candle)

temp_list.append(converted_data)

temp_list_raw.append(candle)

temp_list3 = [np.asarray(temp_list)]

templist4 = np.asarray(temp_list3)

if MinMax==True:

templist99 = scaler.fit_transform(templist4[0])

arr = np.append(arr, [templist99], axis=0)

else:

arr = np.append(arr, templist4, axis=0)

temp_list7 = [np.asarray(temp_list_raw)]

templist8 = np.asarray(temp_list7)

arr3 = np.append(arr3, templist8, axis=0)

converted_data_prediction = ohlc_to_candlestick(data[first_row+lookback])

Prediction = converted_data_prediction[0]

if Multi==True:

if Prediction== 1: Prediction=[1,0]

if Prediction== 0: Prediction=[0,1]

Y_list.append(np.asarray(Prediction))

if Multi==False:

Y_list.append(Prediction)

Y_dates_list.append(data[first_row+lookback][0])

first_row=first_row+1

if (len(data)-lookback-1)<=first_row:first_row=0

arr2 = np.asarray(Y_list)

arr4 = np.asarray(Y_dates_list)

if return_more==True:

yield arr,arr2,arr3,arr4

if return_more==False:

yield arr,arr2