Predict Forex candlestick patterns using Keras.

Check accuracy of candlestick patterns on FOREX dataset

The problem:

Check if it is possible to predict forex price movements only based on candlestick data. We will use 1h time-frame data set of EUR/USD during ~2014-2019 year. We will take only 3 last candles and based on that make a prediction of the next candle.

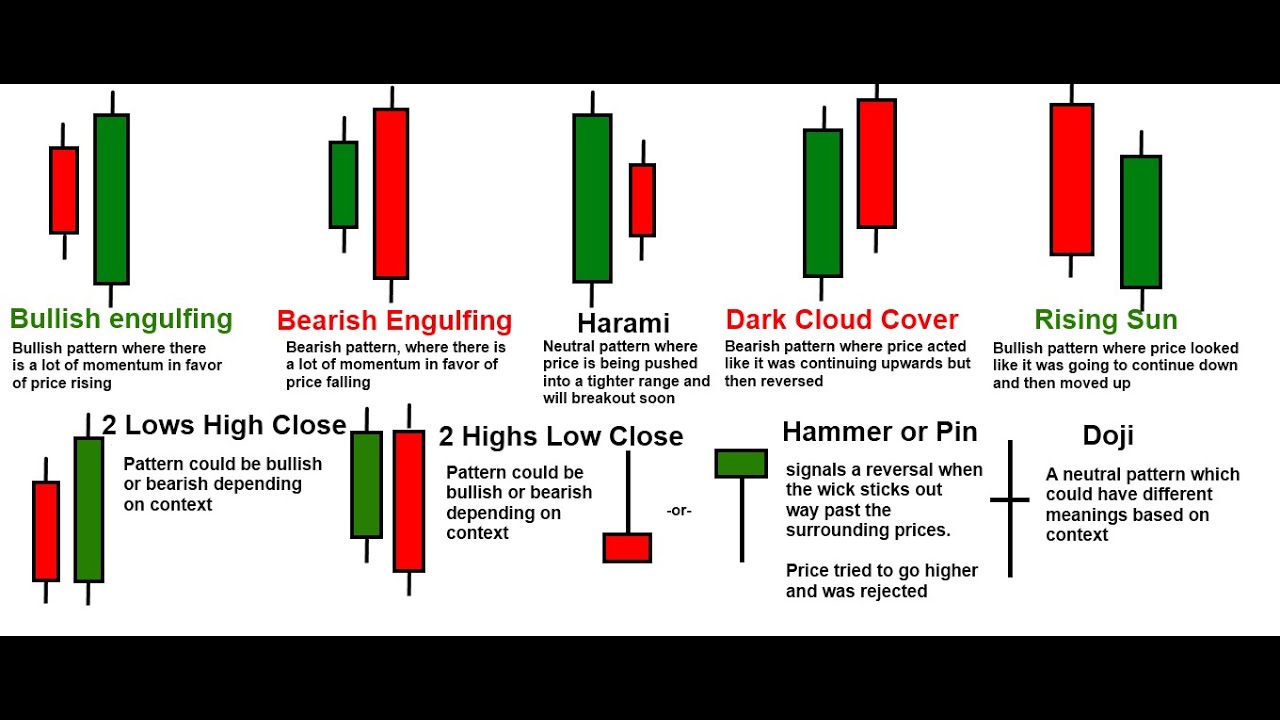

The example of candlestick patterns that we will try to predict or prove that those kind of patterns exists and work:

Before we even start, we need to download all the required libraries to perform the task.

import matplotlib

import numpy as np

import pandas as pd

import itertools

import sklearn

import keras

import time

import shap

from keras.models import Sequential

from keras.layers import Dense, Dropout, CuDNNLSTM, Conv1D

from matplotlib import pyplot as plt

from sklearn import preprocessing

from sklearn.model_selection import train_test_split

import matplotlib.pyplot as plt

import matplotlib.ticker as mticker

from mpl_finance import candlestick_ohlc

print('Numpy version: ' + np.__version__)

print('Pandas version: ' + pd.__version__)

print('Matplotlib version: ' + matplotlib.__version__)

print('Sklearn version: ' + sklearn.__version__)

print('Keras version: ' + keras.__version__)

Numpy version: 1.16.4

Pandas version: 0.24.2

Matplotlib version: 3.1.0

Sklearn version: 0.21.2

Keras version: 2.2.4

Class object to measure time

class MeasureTime:

def __init__(self):

self.start = time.time()

def kill(self):

print ('Time elapsed: ' + time.strftime("%H:%M:%S", time.gmtime(time.time()-self.start)))

del self

Notebook_timer = MeasureTime()

Notebook_timer.kill()

Time elapsed: 00:00:01

1.1 - Import the dataset

We will download our historical dataset from ducascopy website in form of CSV file. https://www.dukascopy.com/trading-tools/widgets/quotes/historical_data_feed

my_dataset = pd.read_csv('EURUSD_1H_2014_2019.csv')

Check the imported data

del my_dataset['Gmt time']

del my_dataset['Volume']

my_dataset.head(5)

| Open | High | Low | Close | |

|---|---|---|---|---|

| 0 | 1.31950 | 1.31956 | 1.31942 | 1.31954 |

| 1 | 1.31954 | 1.31954 | 1.31954 | 1.31954 |

| 2 | 1.31954 | 1.31954 | 1.31954 | 1.31954 |

| 3 | 1.31954 | 1.31954 | 1.31954 | 1.31954 |

| 4 | 1.31954 | 1.31954 | 1.31954 | 1.31954 |

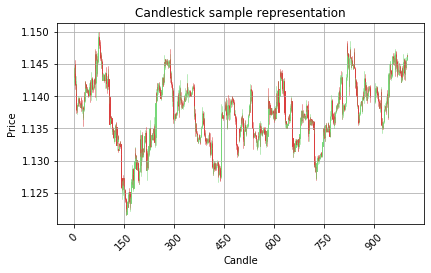

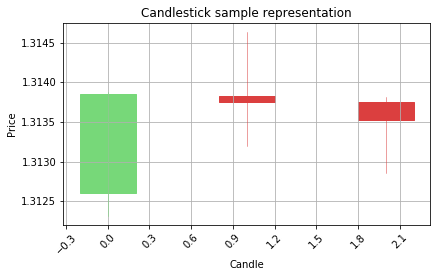

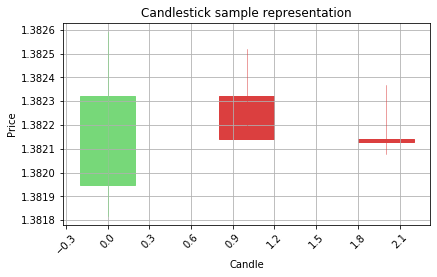

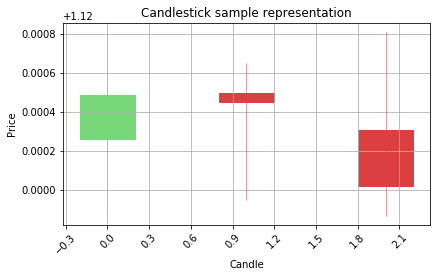

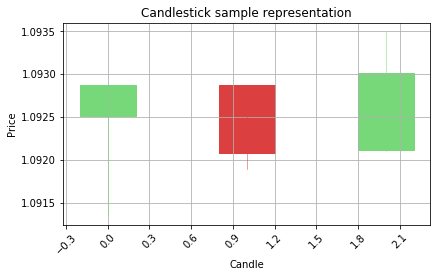

Let’s visualize it on the actual OHLC candlestick chart.

In order to do that we need to make our own function that will plot the OHLC data on the chart. We will use matplotlib library with finnance extension called mpl_finance. But before that, we need prepare out dataset to be in 3 dimensional arre with format (Timestep, Items, Features)

Timestep = List of candles seqeuence

Items = Candlestick

Features = High, Low, Open, Close parametes

Function to plot OHLC candlestick data in to chart

def graph_data_ohlc(dataset):

fig = plt.figure()

ax1 = plt.subplot2grid((1,1), (0,0))

closep=dataset[:,[3]]

highp=dataset[:,[1]]

lowp=dataset[:,[2]]

openp=dataset[:,[0]]

date=range(len(closep))

x = 0

y = len(date)

ohlc = []

while x < y:

append_me = date[x], openp[x], highp[x], lowp[x], closep[x]

ohlc.append(append_me)

x+=1

candlestick_ohlc(ax1, ohlc, width=0.4, colorup='#77d879', colordown='#db3f3f')

for label in ax1.xaxis.get_ticklabels():

label.set_rotation(45)

ax1.xaxis.set_major_locator(mticker.MaxNLocator(10))

ax1.grid(True)

plt.xlabel('Candle')

plt.ylabel('Price')

plt.title('Candlestick sample representation')

plt.subplots_adjust(left=0.09, bottom=0.20, right=0.94, top=0.90, wspace=0.2, hspace=0)

plt.show()

Visualize 1000 candlesticks on the OHLC chart in one time

graph_data_ohlc(my_dataset.tail(1000).values)

1.2 - Converting data to time series format

In order for our machine to learrn from our data, we need to change the format of the data we provide for learning. Most of the human traders do not watch the price but instead, they watch how candlesticks form on the chart and for patterns there. We will look for patterns based on the last 3 candles. To do so, we need to change the format of our dataset to 3 dimensional array (Timestep, Items, Features) .

Custom generator function to create 3d arrays of candles sequence

def my_generator(data,lookback):

final_output = []

counter = 0

first_row = 0

arr = np.empty((1,lookback,4), int)

for a in range(len(data)-lookback):

temp_list = []

for candle in data[first_row:first_row+lookback]:

temp_list.append(candle)

temp_list2 = np.asarray(temp_list)

templist3 = [temp_list2]

templist4 = np.asarray(templist3)

arr = np.append(arr, templist4, axis=0)

first_row=first_row+1

return arr

cell_timer = MeasureTime()

three_dim_sequence = np.asarray(my_generator(my_dataset.values[1:],3))

cell_timer.kill()

Let’s check the shape of our 3 dimension array, we got: 37557 sequences of 3 candles, each candle has 4 parameters.

three_dim_sequence.shape

(37557, 3, 4)

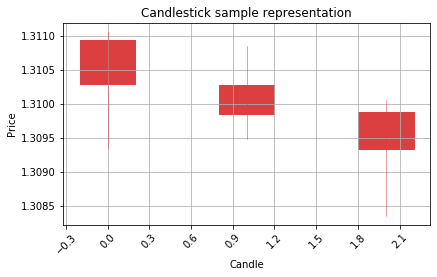

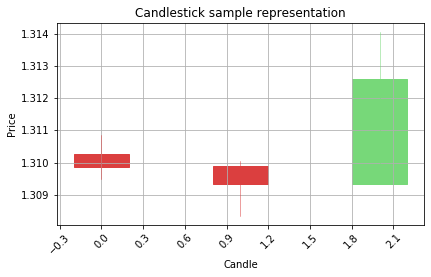

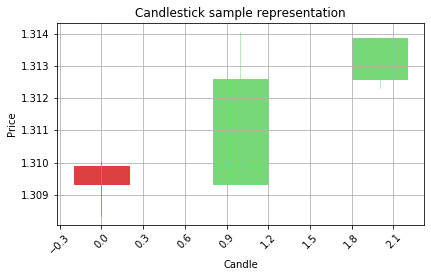

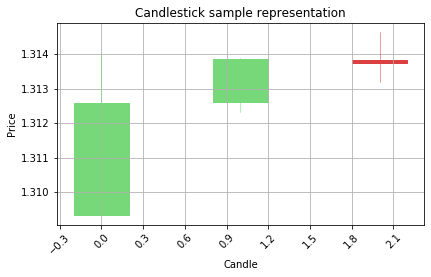

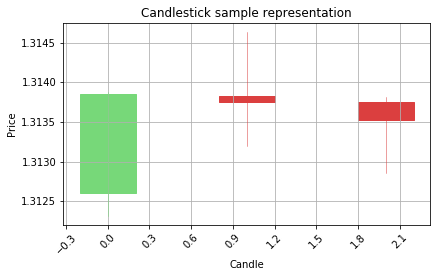

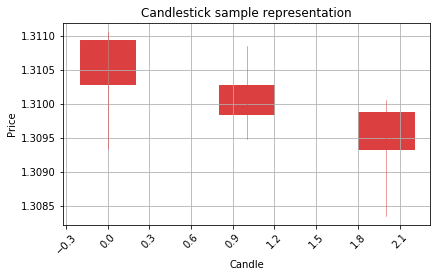

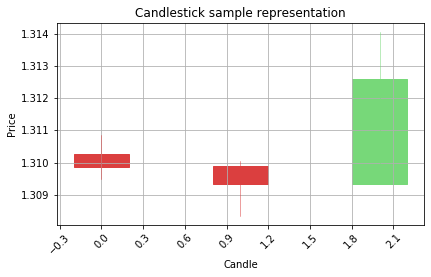

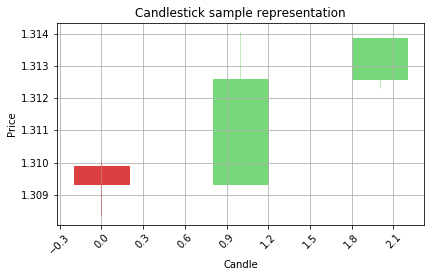

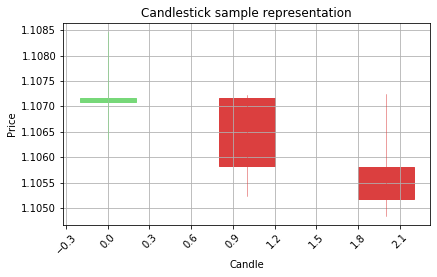

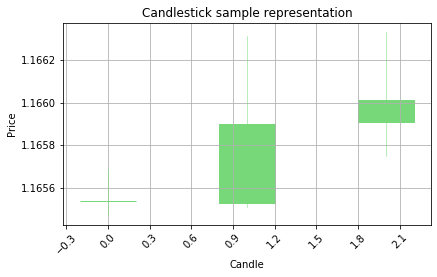

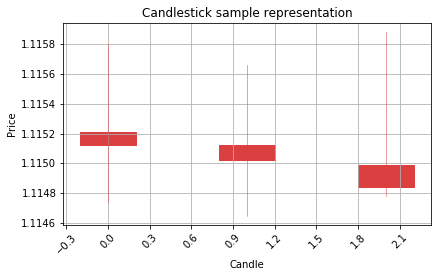

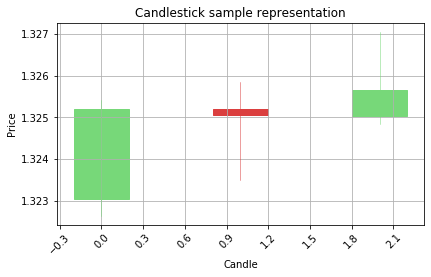

OK, now it is time to see how our sequence of 3 candlesticks looks like on the actual chart

Visualize the step by step sequency of price movements on the OHLC chart

counter=0

for candle in three_dim_sequence[1000:1005]:

counter=counter+1

print('Step ' + str(counter))

graph_data_ohlc(candle)

Step 1

Step 2

Step 3

Step 4

Step 5

1.3 - Feature engineering

Now it is time to convert the price data in to actual candlestick parameters. Each candle has 4 parameters:

- Size of the body measured by pips

- Size of the upper wicks measured by pips

- Size of the lower wicks measured by pips

- Type of the candle (Bullish or Bearish)(Green or Red)(0 or 1)

pip = diffrence between 2 prices multiplied by 10000

(The whole process of enriching the raw dataset is called ‘feature engineering’)

Function to convert OHLC data in to candlestick parameters data

def ohlc_to_candlestick(conversion_array):

candlestick_data = [0,0,0,0]

if conversion_array[3]>conversion_array[0]:

candle_type=1

wicks_up=conversion_array[1]-conversion_array[3]

wicks_down=conversion_array[2]-conversion_array[0]

body_size=conversion_array[3]-conversion_array[0]

else:

candle_type=0

wicks_up=conversion_array[1]-conversion_array[0]

wicks_down=conversion_array[2]-conversion_array[3]

body_size=conversion_array[1]-conversion_array[3]

if wicks_up < 0:wicks_up=wicks_up*(-1)

if wicks_down < 0:wicks_down=wicks_down*(-1)

if body_size < 0:body_size=body_size*(-1)

candlestick_data[0]=candle_type

candlestick_data[1]=round(round(wicks_up,5)*10000,2)

candlestick_data[2]=round(round(wicks_down,5)*10000,2)

candlestick_data[3]=round(round(body_size,5)*10000,2)

return candlestick_data

Lets extract data of only one candle from our dataset of sequences

cell_timer = MeasureTime()

one_candle_data_ohlc=three_dim_sequence[1000:1010][5][1]

cell_timer.kill()

one_candle_data_ohlc

array([1.31375, 1.31381, 1.31286, 1.31353])

Convert it to candlestick parameters

one_candle_data_ohlc_candle=ohlc_to_candlestick(one_candle_data_ohlc)

one_candle_data_ohlc_candle

[0, 0.6, 6.7, 2.8]

Apply this function in to generator function to get sequences with candlestick data instead of OHLC data

def my_generator_candle(data,lookback):

first_row = 0

arr = np.empty((1,lookback,4), int)

for a in range(len(data)-lookback):

temp_list = []

for candle in data[first_row:first_row+lookback]:

converted_data = ohlc_to_candlestick(candle)

temp_list.append(converted_data)

temp_list2 = np.asarray(temp_list)

templist3 = [temp_list2]

templist4 = np.asarray(templist3)

arr = np.append(arr, templist4, axis=0)

first_row=first_row+1

return arr

Get the get the data in form of sequences made from last 3 candles

three_dim_sequence_candle=my_generator_candle(my_dataset.values[1:],3)

Check if conversion applied correctly

three_dim_sequence_candle[5000:5005]

array([[[ 0. , 3.2, 8.6, 10. ],

[ 1. , 2.2, 8.2, 11. ],

[ 0. , 2.5, 9.1, 2.7]],

[[ 1. , 2.2, 8.2, 11. ],

[ 0. , 2.5, 9.1, 2.7],

[ 1. , 6.2, 3.2, 5.3]],

[[ 0. , 2.5, 9.1, 2.7],

[ 1. , 6.2, 3.2, 5.3],

[ 0. , 0.6, 5.4, 16.2]],

[[ 1. , 6.2, 3.2, 5.3],

[ 0. , 0.6, 5.4, 16.2],

[ 0. , 3.4, 6. , 7.4]],

[[ 0. , 0.6, 5.4, 16.2],

[ 0. , 3.4, 6. , 7.4],

[ 1. , 4.8, 8.8, 0.1]]])

Generate forecasting data

Now we have our candlestick values in the correct format for machine to read it and interpret it so, it is time to generete our prediction/forecasting data.

The idea was to predict the next candle type (bullish or bearish) by looking on for the last 3 candles. We got our sequences of 3 candles and now we need to generate another array with one candle information, which we will be forecasting.

Update of the generator to return one more array with 1 or 0 (Bullish or Bearish)

def my_generator_candle_X_Y(data,lookback,MinMax = False):

if MinMax==True:scaler = preprocessing.MinMaxScaler()

first_row = 0

arr = np.empty((0,lookback,4))

arr3 = np.empty((0,lookback,4))

Y_list = []

for a in range(len(data)-lookback):

temp_list = []

temp_list_raw = []

for candle in data[first_row:first_row+lookback]:

converted_data = ohlc_to_candlestick(candle)

temp_list.append(converted_data)

temp_list_raw.append(candle)

temp_list3 = [np.asarray(temp_list)]

templist4 = np.asarray(temp_list3)

if MinMax==True:

templist99 = scaler.fit_transform(templist4[0])

arr = np.append(arr, [templist99], axis=0)

else:

arr = np.append(arr, templist4, axis=0)

temp_list7 = [np.asarray(temp_list_raw)]

templist8 = np.asarray(temp_list7)

arr3 = np.append(arr3, templist8, axis=0)

converted_data_prediction = ohlc_to_candlestick(data[first_row+lookback])

Prediction = converted_data_prediction[0]

Y_list.append(Prediction)

first_row=first_row+1

arr2 = np.asarray(Y_list)

return arr,arr2,arr3

We will call the function and receive 2 datasets:

X = Input dataset on which our neural network will make predictions

Y = Prediction dataset (results of the correct predictions)

cell_timer = MeasureTime()

X,Y, X_raw = my_generator_candle_X_Y(my_dataset.values,3,MinMax=False)

cell_timer.kill()

Exploring the genereted dataset:

print('Shape of X ' + str(X.shape))

print('Shape of Y ' + str(Y.shape))

print('Shape of X raw ohlc ' + str(X_raw.shape))

Shape of X (37557, 3, 4)

Shape of Y (37557,)

Shape of X raw ohlc (37557, 3, 4)

X[653]

array([[ 1. , 4.5, 0.3, 15.8],

[ 1. , 2.6, 1. , 9. ],

[ 0. , 6.3, 7.2, 13.8]])

Y[653]

1

X_raw[653]

array([[1.35109, 1.35312, 1.35106, 1.35267],

[1.35267, 1.35383, 1.35257, 1.35357],

[1.3536 , 1.35423, 1.35213, 1.35285]])

How many bullish and bearish predictions?

unique, counts = np.unique(Y, return_counts=True)

predictions_type = dict(zip(unique, counts))

print('Bull: ' + str((predictions_type[1])) + ' percent: ' + str(round((predictions_type[1]*100)/len(Y),2)) + '%')

print('Bear: ' + str((predictions_type[0])) + ' percent: ' + str(round((predictions_type[0]*100)/len(Y),2)) + '%')

print('Total: ' + str(len(Y)))

Bull: 18622 percent: 49.58%

Bear: 18935 percent: 50.42%

Total: 37557

Now we know that our data for predictions is distributed equally.

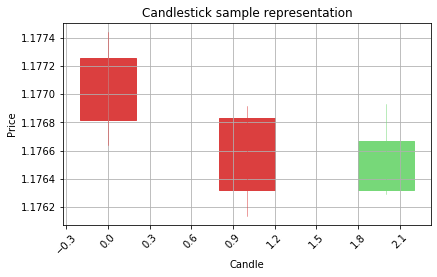

Visualize the candle sequence:

for a in range(5):

b=a+1000

if Y[b] == 1:print('Correct prediction would be Bullish ---^')

if Y[b] == 0:print('Correct prediction would be Bearish ---v')

graph_data_ohlc(X_raw[b])

Correct prediction would be Bullish ---^

Correct prediction would be Bullish ---^

Correct prediction would be Bearish ---v

Correct prediction would be Bearish ---v

Correct prediction would be Bullish ---^

1.4 - Build Deep Learning model

For all sequence dataset the best model are RNN - Recurrent neural network. For our case we will build the LSTM network ( Long-Term Short-Term)

The basics, for all the training and prediction will be responsible the tensorflow library, with high level API called KERAS.

Defining the model

from keras import layers

from keras.optimizers import RMSprop

model = Sequential()

model.add(layers.CuDNNLSTM(units = 12,return_sequences=True, input_shape = (None, X.shape[-1])))

model.add(layers.CuDNNLSTM(units = 24))

model.add(layers.Dense(units = 1,activation='sigmoid'))

model.compile(optimizer='rmsprop', loss='binary_crossentropy', metrics=['acc'])

The model is build from 2 LSTM layers with 12,24 units(so called neurons). More layers and more units we add, more details our model will catch. But there is also a risk, if we add more “space” for model to learn, the model can quickly overfit the trainig data.

Overfiting - Model learned from the data set patterns that describe only the traning dataset. There is no big overview common pattern but instead a lot of small patterns that only apply to traning dataset. In machine learning field there is always a conflict between undertraining and overfitting the model.

Definition of the compiled model

model.summary()

Model: "sequential_7"

_________________________________________________________________

Layer (type) Output Shape Param #

=================================================================

cu_dnnlstm_15 (CuDNNLSTM) (None, None, 12) 864

_________________________________________________________________

cu_dnnlstm_16 (CuDNNLSTM) (None, 24) 3648

_________________________________________________________________

dense_6 (Dense) (None, 1) 25

=================================================================

Total params: 4,537

Trainable params: 4,537

Non-trainable params: 0

_________________________________________________________________

In order train the deep learning model we need to split our data for 3 parts:

- Traning dataset

- Validation dataset

- Test dataset

cell_timer = MeasureTime()

X_train, X_val_and_test, Y_train, Y_val_and_test = train_test_split(X, Y, test_size=0.5)

X_val, X_test, Y_val, Y_test = train_test_split(X_val_and_test, Y_val_and_test, test_size=0.5)

X_train_raw, X_val_and_test_raw= train_test_split(X_raw, test_size=0.5)

X_val_raw, X_test_raw = train_test_split(X_val_and_test_raw, test_size=0.5)

cell_timer.kill()

print('Training data: ' + 'X Input shape: ' + str(X_train.shape) + ', ' + 'Y Output shape: ' + str(Y_train.shape) + ', ' + 'datetime shape: ' + str(Y_train.shape))

print('Validation data: ' + 'X Input shape: ' + str(X_val.shape) + ', ' + 'Y Output shape: ' + str(Y_val.shape) + ', ' + 'datetime shape: ' + str(Y_val.shape))

print('Test data: ' + 'X Input shape: ' + str(X_test.shape) + ', ' + 'Y Output shape: ' + str(Y_test.shape) + ', ' + 'datetime shape: ' + str(Y_test.shape))

Training data: X Input shape: (18778, 3, 4), Y Output shape: (18778,), datetime shape: (18778,)

Validation data: X Input shape: (9389, 3, 4), Y Output shape: (9389,), datetime shape: (9389,)

Test data: X Input shape: (9390, 3, 4), Y Output shape: (9390,), datetime shape: (9390,)

Train the Neural Network model and save trainig outputs ‘history’ variable

We will train the model 13 times and uploud batches with 500 items from our training dataset for one training iteration.

cell_timer = MeasureTime()

history = model.fit(X_train, Y_train,batch_size=500, epochs=13,validation_data=(X_val, Y_val))

cell_timer.kill()

Train on 18778 samples, validate on 9389 samples

Epoch 1/13

18778/18778 [==============================] - 7s 381us/step - loss: 0.6936 - acc: 0.4913 - val_loss: 0.6931 - val_acc: 0.4940

Epoch 2/13

18778/18778 [==============================] - 1s 50us/step - loss: 0.6930 - acc: 0.5067 - val_loss: 0.6938 - val_acc: 0.5011

Epoch 3/13

18778/18778 [==============================] - 1s 42us/step - loss: 0.6926 - acc: 0.5133 - val_loss: 0.6927 - val_acc: 0.5063

Epoch 4/13

18778/18778 [==============================] - 1s 50us/step - loss: 0.6924 - acc: 0.5086 - val_loss: 0.6925 - val_acc: 0.5142

Epoch 5/13

18778/18778 [==============================] - 1s 48us/step - loss: 0.6920 - acc: 0.5173 - val_loss: 0.6923 - val_acc: 0.5110

Epoch 6/13

18778/18778 [==============================] - 1s 49us/step - loss: 0.6917 - acc: 0.5142 - val_loss: 0.6921 - val_acc: 0.5100

Epoch 7/13

18778/18778 [==============================] - 1s 48us/step - loss: 0.6915 - acc: 0.5211 - val_loss: 0.6921 - val_acc: 0.5086

Epoch 8/13

18778/18778 [==============================] - 1s 51us/step - loss: 0.6911 - acc: 0.5196 - val_loss: 0.6921 - val_acc: 0.5110

Epoch 9/13

18778/18778 [==============================] - 1s 51us/step - loss: 0.6908 - acc: 0.5240 - val_loss: 0.6916 - val_acc: 0.5150

Epoch 10/13

18778/18778 [==============================] - ETA: 0s - loss: 0.6905 - acc: 0.522 - 1s 50us/step - loss: 0.6905 - acc: 0.5224 - val_loss: 0.6914 - val_acc: 0.5122

Epoch 11/13

18778/18778 [==============================] - 1s 48us/step - loss: 0.6901 - acc: 0.5256 - val_loss: 0.6918 - val_acc: 0.5134

Epoch 12/13

18778/18778 [==============================] - 1s 51us/step - loss: 0.6898 - acc: 0.5297 - val_loss: 0.6913 - val_acc: 0.5141

Epoch 13/13

18778/18778 [==============================] - 1s 46us/step - loss: 0.6895 - acc: 0.5296 - val_loss: 0.6910 - val_acc: 0.5135

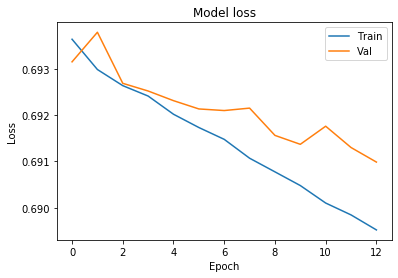

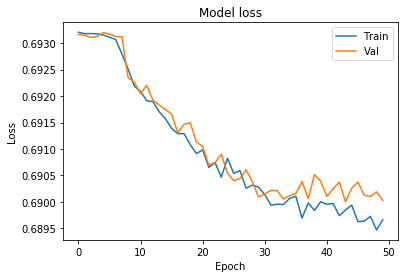

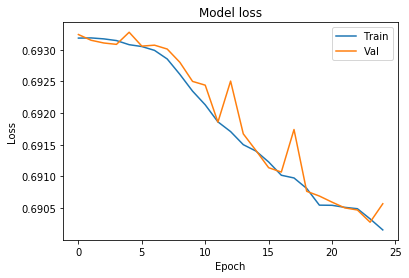

Plot the charts to see model training loss and validation loss

# Chart 1 - Model Loss

#plt.subplot(331)

plt.plot(history.history['loss'])

plt.plot(history.history['val_loss'])

plt.title('Model loss')

plt.ylabel('Loss')

plt.xlabel('Epoch')

plt.legend(['Train', 'Val'], loc='upper right')

plt.show()

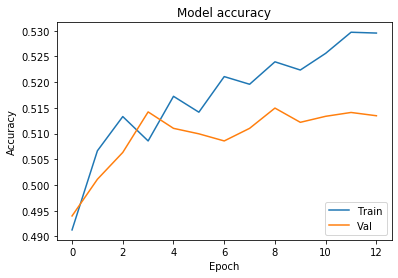

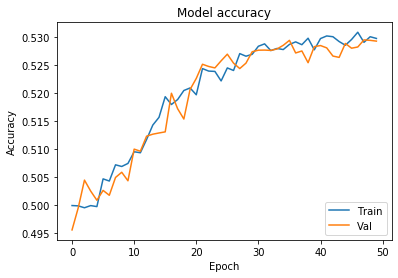

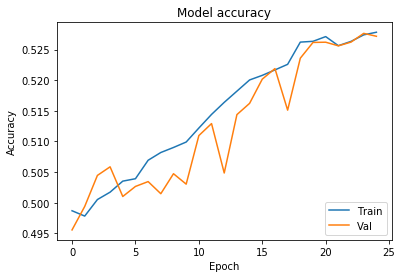

# Chart 2 - Model Accuracy

#plt.subplot(332)

plt.plot(history.history['acc'])

plt.plot(history.history['val_acc'])

plt.title('Model accuracy')

plt.ylabel('Accuracy')

plt.xlabel('Epoch')

plt.legend(['Train', 'Val'], loc='lower right')

plt.show()

1.5 - Test the model against new data

test_loss, test_acc = model.evaluate(X_test, Y_test)

print('Test accuracy:', test_acc)

9390/9390 [==============================] - 2s 219us/step

Test accuracy: 0.5175718849967209

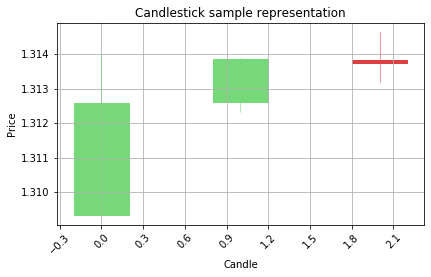

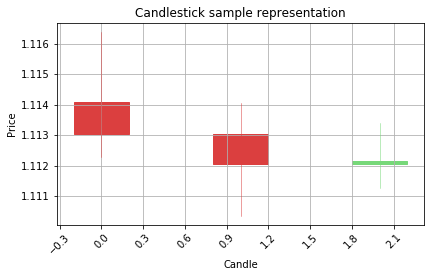

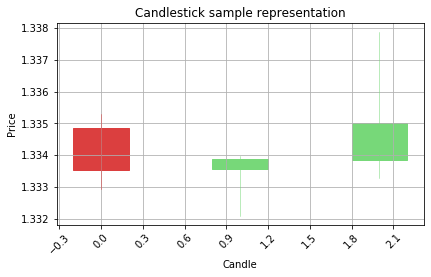

Visualize the predictions on the candlestick charts to see the patterns

Belowe there is a function to filter out the low confidence predictions from the model by using the alpha distance variable. If the prediction value is close to 0, that means the prediction is 0, the same case wth prediction 1, if the predicted value is closer to 1 instead of 0, it means the model predicted the value 1. If the prediction value is closer to its target, that means the confidence of the prediction is biger. Less distance to target prediction value, better the confidence. Please make sure that this approach works only with binary classification problems.

cell_timer = MeasureTime()

counter = 0

won = 0

lost = 0

test = model.predict(X_test)

alpha_distance = 0.35

for a in test:

#print(a)

if a > (1-alpha_distance) or a < alpha_distance :

print(a)

if Y_test[counter] == 1:print('Correct prediction is Bullish')

if Y_test[counter] == 0:print('Correct prediction is Bearish')

if a > (1-alpha_distance):print('Model prediction is Bullish')

if a < alpha_distance:print('Model prediction is Bearish')

if (a > (1-alpha_distance) and Y_test[counter] == 1) or (a < alpha_distance and Y_test[counter] == 0):

won=won+1

print('WON')

else:

print('LOST')

lost=lost+1

graph_data_ohlc(X_test_raw[counter])

counter=counter+1

print('Won: ' + str(won) + ' Lost: ' + str(lost))

print('Success rate: ' + str(round((won*100)/(won+lost),2)) + '%')

cell_timer.kill()

[0.3420222]

Correct prediction is Bearish

Model prediction is Bearish

WON

[0.24589519]

Correct prediction is Bearish

Model prediction is Bearish

WON

[0.24589519]

Correct prediction is Bearish

Model prediction is Bearish

WON

[0.24589519]

Correct prediction is Bearish

Model prediction is Bearish

WON

[0.24589519]

Correct prediction is Bearish

Model prediction is Bearish

WON

[0.24589519]

Correct prediction is Bearish

Model prediction is Bearish

WON

[0.24589519]

Correct prediction is Bearish

Model prediction is Bearish

WON

[0.24589519]

Correct prediction is Bearish

Model prediction is Bearish

WON

[0.31519535]

Correct prediction is Bearish

Model prediction is Bearish

WON

[0.24589519]

Correct prediction is Bearish

Model prediction is Bearish

WON

Won: 52 Lost: 4

Success rate: 92.86%

Looks like we manage the get awesome results with our model after manipulating the alpha_distance value.

Won: 52 Lost: 4

Success rate: 92.86%

Test period: 13 Months

Thats huge!

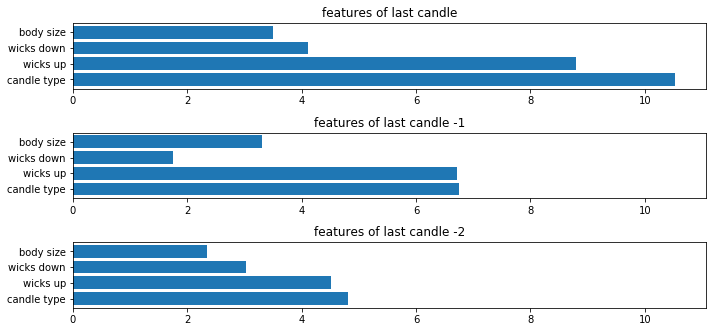

1.6 - Check the model features importance

But the game is not over, when we have our model achieving awesome results on the test data, it is time to move in to data out of the sample (data that is not related to the previous data and the deep learning model never had contact with this kind of data) or to the live data. We will try both of those approaches.

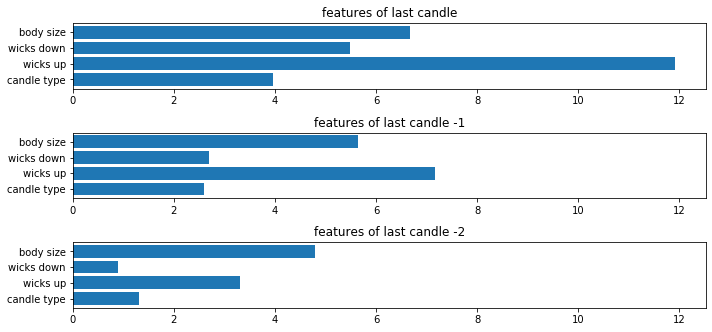

Before will will start making out of the sample test, let’s check which features were the most important for the model to make predictions.

def get_feature_importance(model,X_train_dataset,feature_names):

pred_x = model.predict(X_train_dataset)

random_ind = np.random.choice(X_train.shape[0], 1000, replace=False)

data = X_train[random_ind[0:500]]

e = shap.DeepExplainer((model.layers[0].input, model.layers[-1].output),data)

test1 = X_train[random_ind[500:1000]]

shap_val = e.shap_values(test1)

shap_val = np.array(shap_val)

shap_val = np.reshape(shap_val,(int(shap_val.shape[1]),int(shap_val.shape[2]),int(shap_val.shape[3])))

shap_abs = np.absolute(shap_val)

sum_0 = np.sum(shap_abs,axis=0)

x_pos = [i for i, _ in enumerate(f_names)]

plt.figure(figsize=(10,6))

plt1 = plt.subplot(4,1,1)

plt1.barh(x_pos,sum_0[2])

plt1.set_yticks(x_pos)

plt1.set_yticklabels(feature_names)

plt1.set_title('features of last candle')

plt2 = plt.subplot(4,1,2,sharex=plt1)

plt2.barh(x_pos,sum_0[1])

plt2.set_yticks(x_pos)

plt2.set_yticklabels(feature_names)

plt2.set_title('features of last candle -1')

plt3 = plt.subplot(4,1,3,sharex=plt1)

plt3.barh(x_pos,sum_0[0])

plt3.set_yticks(x_pos)

plt3.set_yticklabels(feature_names)

plt3.set_title('features of last candle -2')

plt.tight_layout()

plt.show()

cell_timer = MeasureTime()

features_list=['candle type','wicks up', 'wicks down', 'body size']

get_feature_importance(model,X_train,features_list)

cell_timer.kill()

Now we can see that model trained itself in a way to pay the most attention to the first candle and the wicks up parameter. The last candle is also less important than the others when it comes to making prediction.

1.7 - The BIG DATA

Now it is time to download the big dataset of more than

0.7 Milion of historical 1 hour candlestciks from 7 currency pairs

We will download our historical dataset from ducascopy website in form of many CSV files. https://www.dukascopy.com/trading-tools/widgets/quotes/historical_data_feed

*EURUSD

*GBPUSD

*USDCAD

*NZDUSD

*USDJPY

*AUDUSD

*USDCHF All of the above datasets are for time period od 2003-2019

EURUSD

cell_timer = MeasureTime()

EURUSD_dataset = pd.read_csv('Hour/EURUSD.csv')

del EURUSD_dataset['Gmt time']

del EURUSD_dataset['Volume']

X,Y, X_raw = my_generator_candle_X_Y(EURUSD_dataset.values,3,MinMax=False)

cell_timer.kill()

GBPUSD

cell_timer = MeasureTime()

GBPUSD_dataset = pd.read_csv('Hour/GBPUSD.csv')

del GBPUSD_dataset['Gmt time']

del GBPUSD_dataset['Volume']

X2,Y2, X2_raw = my_generator_candle_X_Y(GBPUSD_dataset.values,3,MinMax=False)

cell_timer.kill()

USDCAD

cell_timer = MeasureTime()

USDCAD_dataset = pd.read_csv('Hour/USDCAD.csv')

del USDCAD_dataset['Gmt time']

del USDCAD_dataset['Volume']

X3,Y3, X3_raw = my_generator_candle_X_Y(USDCAD_dataset.values,3,MinMax=False)

cell_timer.kill()

NZDUSD

cell_timer = MeasureTime()

NZDUSD_dataset = pd.read_csv('Hour/NZDUSD.csv')

del NZDUSD_dataset['Gmt time']

del NZDUSD_dataset['Volume']

X4,Y4, X4_raw = my_generator_candle_X_Y(NZDUSD_dataset.values,3,MinMax=False)

cell_timer.kill()

USDJPY

cell_timer = MeasureTime()

USDJPY_dataset = pd.read_csv('Hour/USDJPY.csv')

del USDJPY_dataset['Gmt time']

del USDJPY_dataset['Volume']

X5,Y5, X5_raw = my_generator_candle_X_Y(USDJPY_dataset.values,3,MinMax=False)

cell_timer.kill()

AUDUSD

cell_timer = MeasureTime()

AUDUSD_dataset = pd.read_csv('Hour/AUDUSD.csv')

del AUDUSD_dataset['Gmt time']

del AUDUSD_dataset['Volume']

X6, Y6, X6_raw = my_generator_candle_X_Y(AUDUSD_dataset.values,3,MinMax=False)

cell_timer.kill()

Time elapsed: 00:03:30

USDCHF

cell_timer = MeasureTime()

USDCHF_dataset = pd.read_csv('Hour/USDCHF.csv')

del USDCHF_dataset['Gmt time']

del USDCHF_dataset['Volume']

X7,Y7, X7_raw = my_generator_candle_X_Y(USDCHF_dataset.values,3,MinMax=False)

cell_timer.kill()

Time elapsed: 00:03:35

Below function is the update function to calculate the potential accuracy of the model with alpha distance parameter

Aplha distance = maximum accetable distance from predicted value to prediction target.

For example if we want to predict 1 or 0 (1=Bullish , 0=Bearish) and our model will return 0.70, it means that distance to 1 is 0.3 and distance to 0 i 0.7. Smaller the distance = higher accuracy during the prediction

def evaluate_candle_model(model_passed,alpha_distance,X,Y,X_raw,print_charts=False):

counter = 0

won = 0

lost = 0

test = model_passed.predict(X)

for a in test:

if a > (1-alpha_distance) or a < alpha_distance :

if print_charts==True:

print(a)

if Y[counter] == 1:print('Correct prediction is Bullish')

if Y[counter] == 0:print('Correct prediction is Bearish')

if a > (1-alpha_distance):print('Model prediction is Bullish')

if a < alpha_distance:print('Model prediction is Bearish')

if (a > (1-alpha_distance) and Y[counter] == 1) or (a < alpha_distance and Y[counter] == 0):

won=won+1

if print_charts==True:print('WON')

else:

if print_charts==True:print('LOST')

lost=lost+1

if print_charts==True:graph_data_ohlc(X_raw[counter])

counter=counter+1

if won != 0:

print('Won: ' + str(won) + ' Lost: ' + str(lost))

print('Success rate: ' + str(round((won*100)/(won+lost),2)) + '%')

return [won+lost,won,lost]

Lets calculate how our trained model will perform on larger dataset that the model had no access to during the training.

cell_timer = MeasureTime()

alpha_distance = 0.30

total=0

win=0

loss=0

print('EURUSD Prediction:')

evaluation = evaluate_candle_model(model,alpha_distance,X,Y,X_raw,print_charts=False)

total = total + evaluation[0]

win = win + evaluation[1]

loss = loss + evaluation[2]

print('---------------------------------------------------')

print('GBPUSD Prediction:')

evaluation = evaluate_candle_model(model,alpha_distance,X2,Y2,X2_raw,print_charts=False)

total = total + evaluation[0]

win = win + evaluation[1]

loss = loss + evaluation[2]

print('---------------------------------------------------')

print('USDCAD Prediction:')

evaluation = evaluate_candle_model(model,alpha_distance,X3,Y3,X3_raw,print_charts=False)

total = total + evaluation[0]

win = win + evaluation[1]

loss = loss + evaluation[2]

print('---------------------------------------------------')

print('NZDUSD Prediction:')

evaluation = evaluate_candle_model(model,alpha_distance,X4,Y4,X4_raw,print_charts=False)

total = total + evaluation[0]

win = win + evaluation[1]

loss = loss + evaluation[2]

print('---------------------------------------------------')

print('USDJPY Prediction:')

evaluation = evaluate_candle_model(model,alpha_distance,X5,Y5,X5_raw,print_charts=False)

total = total + evaluation[0]

win = win + evaluation[1]

loss = loss + evaluation[2]

print('---------------------------------------------------')

print('AUDUSD Prediction:')

evaluation = evaluate_candle_model(model,alpha_distance,X6,Y6,X6_raw,print_charts=False)

total = total + evaluation[0]

win = win + evaluation[1]

loss = loss + evaluation[2]

print('---------------------------------------------------')

print('USDCHF Prediction:')

evaluation = evaluate_candle_model(model,alpha_distance,X7,Y7,X7_raw,print_charts=False)

total = total + evaluation[0]

win = win + evaluation[1]

loss = loss + evaluation[2]

print('---------------------------------------------------')

print('PREDICTIONS WIN: ' + str(win))

print('PREDICTIONS LOSS: ' + str(loss))

print('PREDICTIONS ACCURACY: ' + str(round((win*100)/(win+loss),2)) + '%')

print('PREDICTIONS PER MONTH: ' + str(round(total/192,0)))

print('PREDICTIONS TEST PERIOD: ' + '16 YEARS (2013-2019)')

cell_timer.kill()

EURUSD Prediction:

Won: 202 Lost: 18

Success rate: 91.82%

---------------------------------------------------

GBPUSD Prediction:

Won: 183 Lost: 11

Success rate: 94.33%

---------------------------------------------------

USDCAD Prediction:

Won: 201 Lost: 8

Success rate: 96.17%

---------------------------------------------------

NZDUSD Prediction:

Won: 225 Lost: 14

Success rate: 94.14%

---------------------------------------------------

US6DJPY Prediction:

Won: 187 Lost: 9

Success rate: 95.41%

---------------------------------------------------

AUDUSD Prediction:

Won: 700 Lost: 81

Success rate: 89.63%

---------------------------------------------------

USDCHF Prediction:

Won: 191 Lost: 11

Success rate: 94.55%

---------------------------------------------------

PREDICTIONS WIN: 1889

PREDICTIONS LOSS: 152

PREDICTIONS ACCURACY: 92.55%

PREDICTIONS PER MONTH: 11.0

PREDICTIONS TEST PERIOD: 16 YEARS (2013-2019)

Time elapsed: 00:06:55

The results are very promising, 92% on 16 year data period. But before we will move further, lets check how many Bullish and Bearish predictions we had.

cell_timer = MeasureTime()

EURUSD_pred_check = model.predict(X)

GBPUSD_pred_check = model.predict(X2)

USDCAD_pred_check = model.predict(X3)

NZDUSD_pred_check = model.predict(X4)

USDJPY_pred_check = model.predict(X5)

AUDUSD_pred_check = model.predict(X6)

USDCHF_pred_check = model.predict(X7)

cell_timer.kill()

Time elapsed: 00:01:44

cell_timer = MeasureTime()

all_currencies_predictions = np.concatenate([EURUSD_pred_check, GBPUSD_pred_check, USDCAD_pred_check,NZDUSD_pred_check,USDJPY_pred_check,AUDUSD_pred_check,USDCHF_pred_check], axis=0)

cell_timer.kill()

Time elapsed: 00:00:00

all_currencies_predictions.shape

(703419, 1)

cell_timer = MeasureTime()

alpha_distance_value = 0.3

bullish_count=0

bearish_count=0

for pred in all_currencies_predictions:

if pred < alpha_distance_value: bearish_count=bearish_count+1

if pred > (1-alpha_distance_value): bullish_count=bullish_count+1

print('Bullish predictions in total: ' + str(bullish_count))

print('Bearish predictions in total: ' + str(bearish_count))

print('Predictions in total: ' + str(bullish_count+bearish_count))

cell_timer.kill()

Bullish predictions in total: 0

Bearish predictions in total: 2041

Predictions in total: 2041

Time elapsed: 00:00:03

Looks like our model learned perfectly how to predict only the bearish candle. All of the predictions above alpha distance are for bearish candles. This is good however the goal is to make predictions with high accuracy for Bearish and Bullish candles. Let’s move further and investigate what could be the problem in here.

Anyway, the results might have something valuable in it, so for now on let’s just save the model in case for future reference.

model.save("predict_candlestick_1.7.h5")

print("Saved model to disk")

Saved model to disk

1.8 Multiple LSTM layers

Now we know how the model with low level of layers and unit/neurons perform on our data, but what if we extend the number of layeres and neurons. We will give to our model more room for training to remember the data. We will also give more data for training instead of a last time. We will take GBP/USD and EUR/USD during period 2003-2019 for training. Maybe increasing the dataset will solve our problem of model learning only to make predictions in one direction.

Get the training data:

cell_timer = MeasureTime()

merged_X = np.concatenate((X, X2), axis=0)

cell_timer.kill()

Time elapsed: 00:00:00

cell_timer = MeasureTime()

merged_Y = np.concatenate((Y, Y2), axis=0)

cell_timer.kill()

Time elapsed: 00:00:00

cell_timer = MeasureTime()

merged_X_rwa = np.concatenate((X_raw, X2_raw), axis=0)

cell_timer.kill()

Time elapsed: 00:00:00

merged_X.shape

(202314, 3, 4)

merged_Y.shape

(202314,)

cell_timer = MeasureTime()

X_train_merged, X_val_and_test, Y_train_merged, Y_val_and_test = train_test_split(merged_X, merged_Y, test_size=0.5)

X_val_merged, X_test_merged, Y_val_merged, Y_test_merged = train_test_split(X_val_and_test, Y_val_and_test, test_size=0.5)

X_train_raw_merged, X_val_and_test_raw= train_test_split(merged_X_rwa, test_size=0.5)

X_val_raw_merged, X_test_raw_merged = train_test_split(X_val_and_test_raw, test_size=0.5)

cell_timer.kill()

Time elapsed: 00:00:00

The new model will be build from 6x LSTM layers with 12,24,24,24,12,6 neurons. You may also spot that right now we have also added layers called “Dropout”

Droput is basically a layer that each time data is passing through it, the layer drops some percentage of this data to avoid overfitting problem.

In simple worlds, it will allow our model to learn longer without overfitting.

from keras import layers

from keras.optimizers import RMSprop

model = Sequential()

model.add(layers.CuDNNLSTM(units = 12,return_sequences=True, input_shape = (None, X.shape[-1])))

model.add(Dropout(0.3))

model.add(layers.CuDNNLSTM(units = 24,return_sequences=True,))

model.add(Dropout(0.3))

model.add(layers.CuDNNLSTM(units = 24,return_sequences=True))

model.add(Dropout(0.3))

model.add(layers.CuDNNLSTM(units = 24,return_sequences=True))

model.add(Dropout(0.2))

model.add(layers.CuDNNLSTM(units = 12,return_sequences=True))

model.add(Dropout(0.2))

model.add(layers.CuDNNLSTM(units = 6))

model.add(layers.Dense(units = 1,activation='sigmoid'))

model.compile(optimizer='rmsprop', loss='binary_crossentropy', metrics=['acc'])

model.summary()

Model: "sequential_3"

_________________________________________________________________

Layer (type) Output Shape Param #

=================================================================

cu_dnnlstm_9 (CuDNNLSTM) (None, None, 12) 864

_________________________________________________________________

dropout_6 (Dropout) (None, None, 12) 0

_________________________________________________________________

cu_dnnlstm_10 (CuDNNLSTM) (None, None, 24) 3648

_________________________________________________________________

dropout_7 (Dropout) (None, None, 24) 0

_________________________________________________________________

cu_dnnlstm_11 (CuDNNLSTM) (None, None, 24) 4800

_________________________________________________________________

dropout_8 (Dropout) (None, None, 24) 0

_________________________________________________________________

cu_dnnlstm_12 (CuDNNLSTM) (None, None, 24) 4800

_________________________________________________________________

dropout_9 (Dropout) (None, None, 24) 0

_________________________________________________________________

cu_dnnlstm_13 (CuDNNLSTM) (None, None, 12) 1824

_________________________________________________________________

dropout_10 (Dropout) (None, None, 12) 0

_________________________________________________________________

cu_dnnlstm_14 (CuDNNLSTM) (None, 6) 480

_________________________________________________________________

dense_3 (Dense) (None, 1) 7

=================================================================

Total params: 16,423

Trainable params: 16,423

Non-trainable params: 0

_________________________________________________________________

Training process:

cell_timer = MeasureTime()

history = model.fit(X_train_merged, Y_train_merged,batch_size=500, epochs=50,validation_data=(X_val_merged, Y_val_merged))

cell_timer.kill()

Train on 101157 samples, validate on 50578 samples

Epoch 1/50

101157/101157 [==============================] - 13s 129us/step - loss: 0.6932 - acc: 0.4999 - val_loss: 0.6932 - val_acc: 0.4956

Epoch 2/50

101157/101157 [==============================] - 11s 106us/step - loss: 0.6932 - acc: 0.4998 - val_loss: 0.6932 - val_acc: 0.4995

Epoch 3/50

101157/101157 [==============================] - 11s 107us/step - loss: 0.6932 - acc: 0.4995 - val_loss: 0.6931 - val_acc: 0.5044

Epoch 4/50

101157/101157 [==============================] - 11s 106us/step - loss: 0.6932 - acc: 0.4999 - val_loss: 0.6931 - val_acc: 0.5025

Epoch 5/50

101157/101157 [==============================] - 11s 108us/step - loss: 0.6932 - acc: 0.4997 - val_loss: 0.6932 - val_acc: 0.5009

Epoch 6/50

101157/101157 [==============================] - 11s 107us/step - loss: 0.6931 - acc: 0.5047 - val_loss: 0.6932 - val_acc: 0.5026

Epoch 7/50

101157/101157 [==============================] - 11s 107us/step - loss: 0.6931 - acc: 0.5043 - val_loss: 0.6931 - val_acc: 0.5017

Epoch 8/50

101157/101157 [==============================] - 11s 107us/step - loss: 0.6928 - acc: 0.5072 - val_loss: 0.6931 - val_acc: 0.5049

Epoch 9/50

101157/101157 [==============================] - 11s 108us/step - loss: 0.6925 - acc: 0.5069 - val_loss: 0.6923 - val_acc: 0.5059

Epoch 10/50

101157/101157 [==============================] - 11s 108us/step - loss: 0.6922 - acc: 0.5074 - val_loss: 0.6923 - val_acc: 0.5043

Epoch 11/50

101157/101157 [==============================] - 10s 102us/step - loss: 0.6921 - acc: 0.5095 - val_loss: 0.6920 - val_acc: 0.5100

Epoch 12/50

101157/101157 [==============================] - 11s 106us/step - loss: 0.6919 - acc: 0.5093 - val_loss: 0.6922 - val_acc: 0.5096

Epoch 13/50

101157/101157 [==============================] - 11s 107us/step - loss: 0.6919 - acc: 0.5117 - val_loss: 0.6919 - val_acc: 0.5123

Epoch 14/50

101157/101157 [==============================] - 11s 107us/step - loss: 0.6917 - acc: 0.5143 - val_loss: 0.6918 - val_acc: 0.5127

Epoch 15/50

101157/101157 [==============================] - 11s 108us/step - loss: 0.6916 - acc: 0.5157 - val_loss: 0.6917 - val_acc: 0.5129

Epoch 16/50

101157/101157 [==============================] - 11s 111us/step - loss: 0.6914 - acc: 0.5194 - val_loss: 0.6917 - val_acc: 0.5131

Epoch 17/50

101157/101157 [==============================] - 11s 107us/step - loss: 0.6913 - acc: 0.5180 - val_loss: 0.6913 - val_acc: 0.5200

Epoch 18/50

101157/101157 [==============================] - 11s 108us/step - loss: 0.6913 - acc: 0.5188 - val_loss: 0.6915 - val_acc: 0.5172

Epoch 19/50

101157/101157 [==============================] - 11s 108us/step - loss: 0.6911 - acc: 0.5205 - val_loss: 0.6915 - val_acc: 0.5154

Epoch 20/50

101157/101157 [==============================] - 11s 106us/step - loss: 0.6909 - acc: 0.5209 - val_loss: 0.6911 - val_acc: 0.5206

Epoch 21/50

101157/101157 [==============================] - 11s 106us/step - loss: 0.6910 - acc: 0.5197 - val_loss: 0.6911 - val_acc: 0.5226

Epoch 22/50

101157/101157 [==============================] - 11s 106us/step - loss: 0.6907 - acc: 0.5244 - val_loss: 0.6907 - val_acc: 0.5251

Epoch 23/50

101157/101157 [==============================] - 11s 106us/step - loss: 0.6907 - acc: 0.5239 - val_loss: 0.6907 - val_acc: 0.5248

Epoch 24/50

101157/101157 [==============================] - 11s 107us/step - loss: 0.6905 - acc: 0.5239 - val_loss: 0.6909 - val_acc: 0.5245

Epoch 25/50

101157/101157 [==============================] - 11s 108us/step - loss: 0.6908 - acc: 0.5222 - val_loss: 0.6905 - val_acc: 0.5258

Epoch 26/50

101157/101157 [==============================] - 11s 109us/step - loss: 0.6905 - acc: 0.5245 - val_loss: 0.6904 - val_acc: 0.5269

Epoch 27/50

101157/101157 [==============================] - 11s 106us/step - loss: 0.6906 - acc: 0.5240 - val_loss: 0.6904 - val_acc: 0.5253

Epoch 28/50

101157/101157 [==============================] - 11s 109us/step - loss: 0.6903 - acc: 0.5271 - val_loss: 0.6906 - val_acc: 0.5244

Epoch 29/50

101157/101157 [==============================] - 11s 108us/step - loss: 0.6903 - acc: 0.5266 - val_loss: 0.6904 - val_acc: 0.5253

Epoch 30/50

101157/101157 [==============================] - 11s 110us/step - loss: 0.6903 - acc: 0.5269 - val_loss: 0.6901 - val_acc: 0.5274

Epoch 31/50

101157/101157 [==============================] - 11s 110us/step - loss: 0.6901 - acc: 0.5284 - val_loss: 0.6902 - val_acc: 0.5277

Epoch 32/50

101157/101157 [==============================] - 11s 106us/step - loss: 0.6899 - acc: 0.5288 - val_loss: 0.6902 - val_acc: 0.5277

Epoch 33/50

101157/101157 [==============================] - 11s 106us/step - loss: 0.6900 - acc: 0.5276 - val_loss: 0.6902 - val_acc: 0.5276

Epoch 34/50

101157/101157 [==============================] - 11s 109us/step - loss: 0.6899 - acc: 0.5280 - val_loss: 0.6901 - val_acc: 0.5279

Epoch 35/50

101157/101157 [==============================] - 11s 109us/step - loss: 0.6901 - acc: 0.5278 - val_loss: 0.6901 - val_acc: 0.5285

Epoch 36/50

101157/101157 [==============================] - 11s 110us/step - loss: 0.6901 - acc: 0.5287 - val_loss: 0.6902 - val_acc: 0.5294

Epoch 37/50

101157/101157 [==============================] - 11s 108us/step - loss: 0.6897 - acc: 0.5291 - val_loss: 0.6904 - val_acc: 0.5272

Epoch 38/50

101157/101157 [==============================] - 11s 107us/step - loss: 0.6900 - acc: 0.5286 - val_loss: 0.6901 - val_acc: 0.5275

Epoch 39/50

101157/101157 [==============================] - 11s 108us/step - loss: 0.6898 - acc: 0.5298 - val_loss: 0.6905 - val_acc: 0.5254

Epoch 40/50

101157/101157 [==============================] - 11s 109us/step - loss: 0.6900 - acc: 0.5277 - val_loss: 0.6904 - val_acc: 0.5283

Epoch 41/50

101157/101157 [==============================] - 11s 107us/step - loss: 0.6900 - acc: 0.5297 - val_loss: 0.6901 - val_acc: 0.5285

Epoch 42/50

101157/101157 [==============================] - 11s 106us/step - loss: 0.6900 - acc: 0.5302 - val_loss: 0.6902 - val_acc: 0.5281

Epoch 43/50

101157/101157 [==============================] - 11s 109us/step - loss: 0.6897 - acc: 0.5301 - val_loss: 0.6904 - val_acc: 0.5266

Epoch 44/50

101157/101157 [==============================] - 11s 109us/step - loss: 0.6898 - acc: 0.5292 - val_loss: 0.6900 - val_acc: 0.5264

Epoch 45/50

101157/101157 [==============================] - 11s 108us/step - loss: 0.6899 - acc: 0.5285 - val_loss: 0.6903 - val_acc: 0.5289

Epoch 46/50

101157/101157 [==============================] - 11s 110us/step - loss: 0.6896 - acc: 0.5296 - val_loss: 0.6904 - val_acc: 0.5280

Epoch 47/50

101157/101157 [==============================] - 11s 109us/step - loss: 0.6896 - acc: 0.5309 - val_loss: 0.6901 - val_acc: 0.5282

Epoch 48/50

101157/101157 [==============================] - 11s 110us/step - loss: 0.6897 - acc: 0.5291 - val_loss: 0.6901 - val_acc: 0.5295

Epoch 49/50

101157/101157 [==============================] - 11s 106us/step - loss: 0.6895 - acc: 0.5301 - val_loss: 0.6902 - val_acc: 0.5294

Epoch 50/50

101157/101157 [==============================] - 11s 109us/step - loss: 0.6897 - acc: 0.5298 - val_loss: 0.6900 - val_acc: 0.5293

Time elapsed: 00:09:09

# Chart 1 - Model Loss

#plt.subplot(331)

plt.plot(history.history['loss'])

plt.plot(history.history['val_loss'])

plt.title('Model loss')

plt.ylabel('Loss')

plt.xlabel('Epoch')

plt.legend(['Train', 'Val'], loc='upper right')

plt.show()

# Chart 2 - Model Accuracy

#plt.subplot(332)

plt.plot(history.history['acc'])

plt.plot(history.history['val_acc'])

plt.title('Model accuracy')

plt.ylabel('Accuracy')

plt.xlabel('Epoch')

plt.legend(['Train', 'Val'], loc='lower right')

plt.show()

Looks like our model is getting overfitted by the ~25th epoch. let’s train it again only for 25 epochs.

from keras import layers

from keras.optimizers import RMSprop

model = Sequential()

model.add(layers.CuDNNLSTM(units = 12,return_sequences=True, input_shape = (None, X.shape[-1])))

model.add(Dropout(0.3))

model.add(layers.CuDNNLSTM(units = 24,return_sequences=True,))

model.add(Dropout(0.3))

model.add(layers.CuDNNLSTM(units = 24,return_sequences=True))

model.add(Dropout(0.3))

model.add(layers.CuDNNLSTM(units = 24,return_sequences=True))

model.add(Dropout(0.2))

model.add(layers.CuDNNLSTM(units = 12,return_sequences=True))

model.add(Dropout(0.2))

model.add(layers.CuDNNLSTM(units = 6))

model.add(layers.Dense(units = 1,activation='sigmoid'))

model.compile(optimizer='rmsprop', loss='binary_crossentropy', metrics=['acc'])

cell_timer = MeasureTime()

history = model.fit(X_train_merged, Y_train_merged,batch_size=500, epochs=25,validation_data=(X_val_merged, Y_val_merged))

cell_timer.kill()

Train on 101157 samples, validate on 50578 samples

Epoch 1/25

101157/101157 [==============================] - 14s 135us/step - loss: 0.6932 - acc: 0.4987 - val_loss: 0.6932 - val_acc: 0.4956

Epoch 2/25

101157/101157 [==============================] - 11s 108us/step - loss: 0.6932 - acc: 0.4978 - val_loss: 0.6931 - val_acc: 0.4994

Epoch 3/25

101157/101157 [==============================] - 11s 109us/step - loss: 0.6932 - acc: 0.5005 - val_loss: 0.6931 - val_acc: 0.5044

Epoch 4/25

101157/101157 [==============================] - 11s 109us/step - loss: 0.6931 - acc: 0.5017 - val_loss: 0.6931 - val_acc: 0.5059

Epoch 5/25

101157/101157 [==============================] - 11s 108us/step - loss: 0.6931 - acc: 0.5035 - val_loss: 0.6933 - val_acc: 0.5010

Epoch 6/25

101157/101157 [==============================] - 11s 107us/step - loss: 0.6930 - acc: 0.5039 - val_loss: 0.6931 - val_acc: 0.5026

Epoch 7/25

101157/101157 [==============================] - 11s 106us/step - loss: 0.6930 - acc: 0.5069 - val_loss: 0.6931 - val_acc: 0.5034

Epoch 8/25

101157/101157 [==============================] - 11s 110us/step - loss: 0.6929 - acc: 0.5082 - val_loss: 0.6930 - val_acc: 0.5015

Epoch 9/25

101157/101157 [==============================] - 11s 107us/step - loss: 0.6926 - acc: 0.5090 - val_loss: 0.6928 - val_acc: 0.5047

Epoch 10/25

101157/101157 [==============================] - 11s 109us/step - loss: 0.6923 - acc: 0.5099 - val_loss: 0.6925 - val_acc: 0.5030

Epoch 11/25

101157/101157 [==============================] - 11s 111us/step - loss: 0.6921 - acc: 0.5122 - val_loss: 0.6924 - val_acc: 0.5110

Epoch 12/25

101157/101157 [==============================] - 11s 107us/step - loss: 0.6919 - acc: 0.5144 - val_loss: 0.6919 - val_acc: 0.5129

Epoch 13/25

101157/101157 [==============================] - 11s 107us/step - loss: 0.6917 - acc: 0.5164 - val_loss: 0.6925 - val_acc: 0.5048

Epoch 14/25

101157/101157 [==============================] - 11s 107us/step - loss: 0.6915 - acc: 0.5182 - val_loss: 0.6917 - val_acc: 0.5144

Epoch 15/25

101157/101157 [==============================] - 11s 106us/step - loss: 0.6914 - acc: 0.5200 - val_loss: 0.6914 - val_acc: 0.5162

Epoch 16/25

101157/101157 [==============================] - 11s 107us/step - loss: 0.6912 - acc: 0.5208 - val_loss: 0.6911 - val_acc: 0.5202

Epoch 17/25

101157/101157 [==============================] - 11s 109us/step - loss: 0.6910 - acc: 0.5217 - val_loss: 0.6911 - val_acc: 0.5219

Epoch 18/25

101157/101157 [==============================] - 11s 110us/step - loss: 0.6910 - acc: 0.5226 - val_loss: 0.6917 - val_acc: 0.5151

Epoch 19/25

101157/101157 [==============================] - 11s 109us/step - loss: 0.6908 - acc: 0.5262 - val_loss: 0.6908 - val_acc: 0.5236

Epoch 20/25

101157/101157 [==============================] - 11s 106us/step - loss: 0.6905 - acc: 0.5263 - val_loss: 0.6907 - val_acc: 0.5262

Epoch 21/25

101157/101157 [==============================] - 11s 107us/step - loss: 0.6905 - acc: 0.5271 - val_loss: 0.6906 - val_acc: 0.5262

Epoch 22/25

101157/101157 [==============================] - 11s 110us/step - loss: 0.6905 - acc: 0.5256 - val_loss: 0.6905 - val_acc: 0.5256

Epoch 23/25

101157/101157 [==============================] - 11s 104us/step - loss: 0.6905 - acc: 0.5263 - val_loss: 0.6905 - val_acc: 0.5262

Epoch 24/25

101157/101157 [==============================] - 11s 107us/step - loss: 0.6903 - acc: 0.5274 - val_loss: 0.6903 - val_acc: 0.5276

Epoch 25/25

101157/101157 [==============================] - 11s 108us/step - loss: 0.6902 - acc: 0.5278 - val_loss: 0.6906 - val_acc: 0.5272

Time elapsed: 00:04:37

# Chart 1 - Model Loss

#plt.subplot(331)

plt.plot(history.history['loss'])

plt.plot(history.history['val_loss'])

plt.title('Model loss')

plt.ylabel('Loss')

plt.xlabel('Epoch')

plt.legend(['Train', 'Val'], loc='upper right')

plt.show()

# Chart 2 - Model Accuracy

#plt.subplot(332)

plt.plot(history.history['acc'])

plt.plot(history.history['val_acc'])

plt.title('Model accuracy')

plt.ylabel('Accuracy')

plt.xlabel('Epoch')

plt.legend(['Train', 'Val'], loc='lower right')

plt.show()

Evaluate how good is the new model:

Concatonate all the curencies we got left and evaluate model on them

cell_timer = MeasureTime()

merged_curr_test_X = np.concatenate([X3,X4,X5,X6,X7], axis=0)

merged_curr_test_Y = np.concatenate([Y3,Y4,Y5,Y6,Y7], axis=0)

merged_curr_test_X_raw = np.concatenate([X3_raw,X4_raw,X5_raw,X6_raw,X7_raw], axis=0)

cell_timer.kill()

Time elapsed: 00:03:07

print(merged_curr_test_X.shape)

print(merged_curr_test_Y.shape)

print(merged_curr_test_X_raw.shape)

(501105, 3, 4)

(501105,)

(501105, 3, 4)

Evaluate:

cell_timer = MeasureTime()

merged_evaluation = evaluate_candle_model(model,0.3,merged_curr_test_X,merged_curr_test_Y,merged_curr_test_X_raw,print_charts=False)

cell_timer.kill()

Won: 1963 Lost: 397

Success rate: 83.18%

Check how many bullish and bearish trades we have:

cell_timer = MeasureTime()

all_currencies_predictions_merged = model.predict(merged_curr_test_X)

alpha_distance_value = 0.3

bullish_count=0

bearish_count=0

for pred in all_currencies_predictions_merged:

if pred < alpha_distance_value: bearish_count=bearish_count+1

if pred > (1-alpha_distance_value): bullish_count=bullish_count+1

print('Bullish predictions in total: ' + str(bullish_count))

print('Bearish predictions in total: ' + str(bearish_count))

print('Predictions in total: ' + str(bullish_count+bearish_count))

cell_timer.kill()

Bullish predictions in total: 0

Bearish predictions in total: 2360

Predictions in total: 2360

Time elapsed: 00:01:56

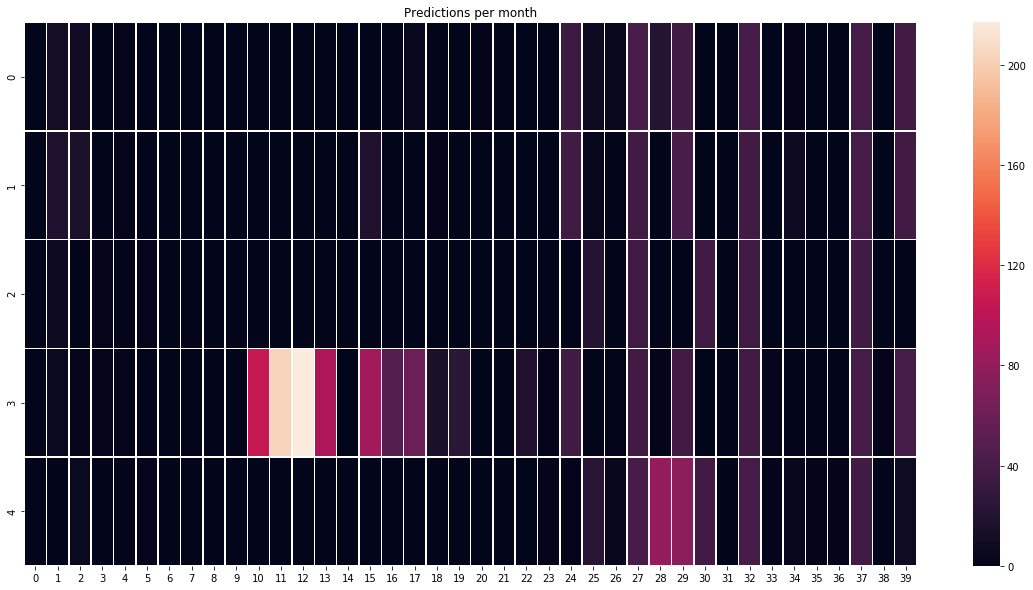

How those predictions are located over time?

def predictions_group(Predictions,timeperiod,alpha_distance_value):

output = []

templist=[]

addval=0

counter=0

for pre in Predictions:

if counter % timeperiod == 0:

output.append(sum(templist.copy()))

templist=[]

if pre < alpha_distance_value: addval = 1

elif pre > (1-alpha_distance_value): addval = 1

else:

addval = 0

templist.append(addval)

counter=counter+1

return output

cell_timer = MeasureTime()

USDCAD_pred_month = predictions_group(model.predict(X3),2500,0.3)

NZDUSD_pred_month = predictions_group(model.predict(X4),2500,0.3)

USDJPY_pred_month = predictions_group(model.predict(X5),2500,0.3)

AUDUSD_pred_month = predictions_group(model.predict(X6),2500,0.3)

USDCHF_pred_month = predictions_group(model.predict(X7),2500,0.3)

cell_timer.kill()

Time elapsed: 00:00:56

import seaborn as sns

heat_map_data = np.random.random((5, 40))

a[0] = np.array(USDCAD_pred_month)

a[1] = np.array(NZDUSD_pred_month)

a[2] = np.array(USDJPY_pred_month[:40])

a[3] = np.array(AUDUSD_pred_month)

a[4] = np.array(USDCHF_pred_month[:40])

plt.figure(figsize=(20,10))

ax = sns.heatmap(a, linewidth=0.5)

#plt.imshow(a, cmap='hot', interpolation='nearest')

plt.title('Predictions per month')

plt.show()

We can see that our model is making predictions onlu in ~10 months out of 40 so it is 25%. It is not good.

Chek which feature is the most important

cell_timer = MeasureTime()

features_list_merged=['candle type','wicks up', 'wicks down', 'body size']

get_feature_importance(model,X_train_merged,features_list_merged)

cell_timer.kill()

Time elapsed: 00:00:30

Save the model for future reference

model.save("predict_candlestick_1.8.h5")

print("Saved model to disk")

Saved model to disk

1.9 - Conclusion

We did:

- loaded data from ducascopy servers

- format the data to time series

- format the OHLC data to candlestick data

- trained 2 LSTM models with diffrent parameters but both we accuracy above 80% in total

Problems:

- the model is learning only to predict bearish positions somehow, regardless diversified dataset.

- the model is overfitted, it is making predictions only in 10 months out of 40